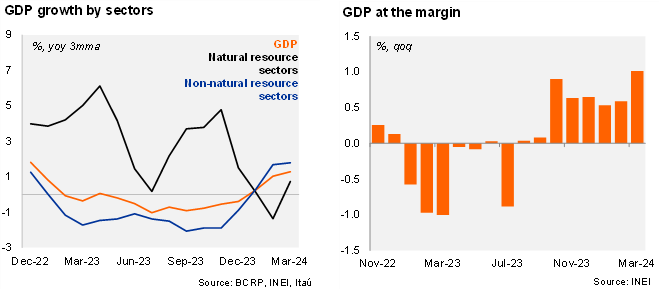

The monthly GDP proxy fell by 0.3% YoY in March (from 2.9% in February), below our forecast of +0.9% and market expectations of +0.8% (as per Bloomberg). We note the monthly activity figure was partly dragged by an unfavorable calendar base effect due to Easter Holidays. The weaker-than-expected print takes place on the back of February’s positive surprise, when activity rose by 2.9% YoY, above the market consensus of 2.1%. Looking at March’s breakdown, fishing output (-32.5% YoY in March), manufacturing production (-9.6%) and construction (-2.5%) were a drag to the headline figure. On the other hand, mining output (2.6%) expanded at a decent pace, while services expanded by 2.4% (although still below the 10-year average of 3.1%). Momentum remained soft, with the 1Q24 annual growth rate at 1.3%. Using official seasonally adjusted series, the monthly GDP fell by 0.3% MoM/SA in March, taking the quarter over quarter (non-annualized) growth rate to 1.0% in 1Q24 (from 0.6% in 4Q23).

Our take: A fragile activity recovery amid well behaved inflation increases the odds for another policy rate cut of 25-bp in June’s monetary policy meeting. However, our base scenario remains for no policy rate cuts during the rest of the year amid the narrowing of the BCRP-Fed rate differential (risking pressure to the currency). We think another reserve requirement adjustment (easing financial conditions) is more likely. Our GDP growth forecast for 2024 stands at 2.8% (after falling by 0.6% last year) supported by positive terms of trade and a favorable external demand.