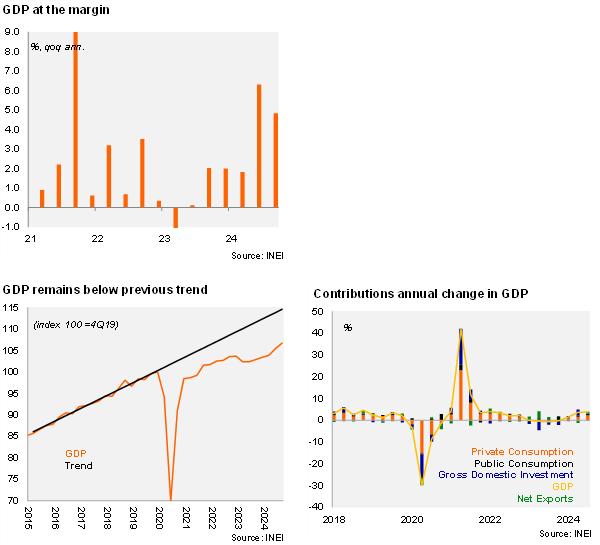

Activity recovery on track. Peru’s real GDP rose by 3.8% yoy during 3q24, above the Bloomberg consensus and our call (3.2%), up slightly from the 3.6% yoy in the previous quarter. On a sequential basis, real GDP printed at a robust 4.8% QoQ SA ann. in 3Q24, decelerating from the 6.3% qoq sa ann. in 2Q24.

GDP growth in 3Q24 was driven by private consumption and exports. Private consumption grew 3.5% yoy in 3Q24, up from the previous quarter due to the state of the labor market and the recovery of real incomes (2Q24: 2.3% yoy). Public consumption grew 4.6% yoy in 3Q24, also up from the previous quarter (2Q24: 3.6% yoy). Private gross fixed investment grew 4% driven by residential non-mining investment (2Q24: 0.1% yoy), while public gross fixed investment jumped by 18.8% (2Q24: 16.2%). Thus, domestic demand advanced 2.8% in 3Q24, moderating from the previous quarter due to lower inventories, in contrast to the accumulation recorded in the previous quarter (2Q24: 5% yoy). Exports rose by 10.9% while imports increased 7%. As a result, net exports contributed 1.01% to annual GDP growth. Overall, the carryover for 2024 stands at 2.9%.

Our Take: The activity recovery remains on track. Most business confidence indicators remain in positive territory, while imports of capital goods rose by 12% in the third quarter. However, the bouts of strikes related to security concerns pose transitory downside risks to activity. We estimate that each day of protest has an impact of 0.1 pp of quarterly GDP. We revised our 2024 growth forecast down to 2.9% (from an above-consensus 3.1%), implying growth sequentially flat in 4Q24. A renewed US-China trade war poses downside risks to Peru’s growth outlook for 2025 and beyond, through a weaker external impulse and lower terms of trade. One third of Peru’s exports are destined to China. We expect GDP to grow 2.8% in 2025, slightly below potential of 3.0%.