2026/01/23 | Diego Ciongo & Soledad Castagna

At today´s Monetary Policy Committee (MPC) meeting, the Central Bank unanimously decided to cut the monetary policy rate (MPR) by 25-bps, to 5.75%, marking the first cut since March 2024. The cut surprised us and market consensus, which anticipated an on-hold decision.

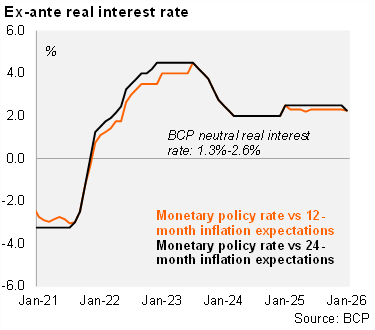

The MPC highlighted that inflationary pressures have eased in recent months, primarily due to lower inflation in goods. Inflation is expected to continue decelerating during most of 2026, converging to the target towards the end of the year. Additionally, the Committee highlighted the consolidation of inflation expectations at the target of 3.5% across different horizons. After today’s decision, we estimate the one‑year ex‑ante real policy rate at 2.25%, remaining towards the upper bound of the BCP’s neutral real interest rate range (1.3%–2.6%).

Furthermore, the MPC noted that economic activity remained robust in 4Q25, in line with an estimated GDP growth rate of 6.0% for that year. For 2026, the BCP´s GDP growth forecast stands at 4.2%, it means around potential.

The MPC also reaffirmed its commitment to price stability and stated that it will continue to closely monitor domestic and external developments to anticipate their potential implications for the inflation path and take timely actions to ensure compliance with the 3.5% inflation target over the monetary policy horizon.

Regarding external scenario, markets anticipate that the Federal Reserve could continue reducing the federal funds target range during 2026.

Our take: In light of today’s 25-bp rate cut, we are revising our terminal policy rate forecast to 5.25% for YE26, down from 6.00% previously. BCP's inflation estimation suggests it will continue decelerating throughout 2026, reaching the target by year-end. This supports our prediction of lower interest rates in the coming months. Additionally, we estimate that the nominal neutral interest rate range is between 4.8% and 6.1%, with a median value of 5.2%. The next monetary policy meeting is scheduled for February 20.