2025/12/02 | Diego Ciongo & Soledad Castagna

Consumer prices rose by 0.2% MoM in November, below our forecast (0.3%), but in line with the central bank’s survey (0.2%). Increases in volatile fresh fruits (17.3% MoM), beef meat (1.5% MoM) and services (0.4% MoM), were partially offset by lower vegetables prices (-11.2% MoM). The core CPI X1 (which excludes fruits and vegetables, regulated service prices and fuel) increased by 0.4% MoM, up from 0.0% MoM in October, but down from 0.9% MoM a year ago.

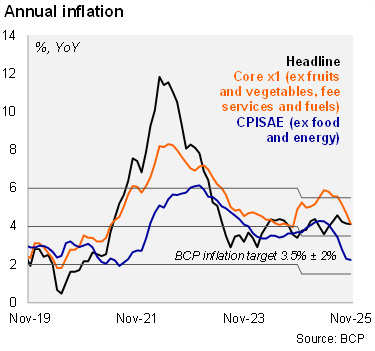

On an annual basis, headline inflation was unchanged at 4.1% in November, while the core X1 CPI fell to 4.1%, from 4.7% in October. Cumulative headline inflation in the year reaches 3.4%. Both headline inflation and core X1 remain within the tolerance range of the BCP’s inflation target (3.5% +/- 2%).

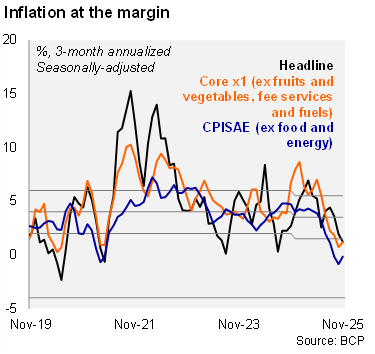

At the margin, headline inflation decelerated while core inflation accelerated in November. Using our seasonally adjusted figures, the three-month annualized headline inflation reading fell to 1.2% in November (down from 1.9% in October), while core inflation increased to 1.2%, from 0.7% in the previous month.

Our heat map shows that 75% of the items are below the central bank's 3.5% inflation target, up from October 2025 (67%), and higher than the level seen in the end-of-2024 data (58%).

Our take: Our 2025 inflation forecast stands at 3.9%. The recent reduction in fuel prices for December introduces downside risks to our yearend inflation call. December’s CPI will be published on December 30. Our forecast for 2026 remains at 3.5%, in line with the BCP’s target.