At today's monthly monetary policy meeting, the BCP kept the monetary policy rate at 6.00% for the sixteenth consecutive month, in line with our call and market expectations (according to the BCP’s survey).

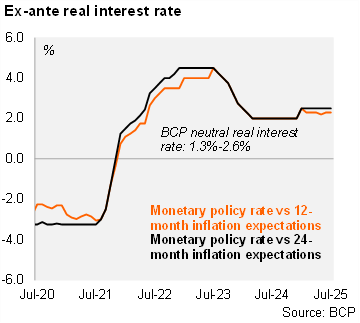

According to the statement, the committee reaffirmed its commitment to price stability and will continue to monitor domestic and external developments closely, anticipating their potential implications for inflation, and will take appropriate measures to ensure compliance with the 3.5% target over the monetary policy horizon. Moreover, the BCP highlighted the stabilization in 12-month inflation expectations. Therefore, we estimate that the real ex-ante policy rate remains at 2.5% (using expectations for the monetary policy horizon), compared to the BCP's neutral real interest rate range of 1.3%-2.6%.

The BCP revised its 2025 GDP growth forecast upwards to 4.4%, from 4.0%, while the inflation forecast for the end of the year was revised upwards to 4.0%, up from 3.8%, primarily due to higher meat prices.

Regarding the global context, the BCP highlighted the increase in oil prices in the face of renewed conflict in the Middle East. Meanwhile, the market expects the Federal Reserve to resume cuts in the second half of the year.

Our take: We forecast a policy rate of 6.00% for YE25. The policy rate is already at the upper bound of the BCP’s neutral range in real ex-ante terms. Leading indicators suggest positive momentum in economic activity, while inflation expectations for the monetary policy horizon (18-24 months) remain stable. The next monthly monetary policy meeting is scheduled for August 22.