2025/09/23 | Diego Ciongo & Soledad Castagna

At today's monthly monetary policy meeting, the BCP kept the monetary policy rate at 6.00% for the eighteenth consecutive month, in line with our call and market expectations (according to the BCP’s survey).

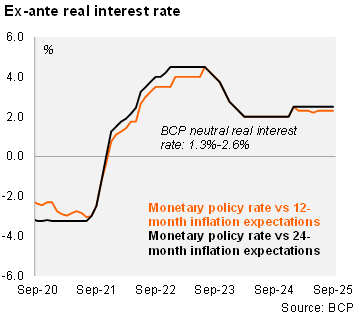

According to the statement, the committee reaffirmed its commitment to price stability and will continue to closely monitor domestic and external developments, anticipating their potential implications for inflation, and will take appropriate measures to ensure compliance with the 3.5% target over the monetary policy horizon. Therefore, we estimate that the real ex-ante policy rate remains at 2.5% (using expectations for the monetary policy horizon), compared to the BCP's neutral real interest rate range of 1.3%-2.6%.

In terms of the global context, the BCP noted that trade tensions have eased due to tariff agreements reached by the U.S. government with certain countries. The market expects the Federal Reserve to cut its policy rate range further at upcoming meetings this year. Furthermore, oil prices have declined since the last meeting.

Our take: We forecast a policy rate of 6.00% for the end of 2025. The policy rate is already at the upper bound of the BCP’s neutral range in real ex-ante terms. Leading indicators suggest positive momentum in economic activity, while inflation expectations for the monetary policy horizon (18-24 months) remain stable. The next monthly monetary policy meeting is scheduled for October 24.