2025/12/22 | Diego Ciongo & Soledad Castagna

In December’s monetary policy meeting, the BCP maintained the policy rate at 6.0%, unchanged since March 2024, in line with our call and market expectations (according to the BCP’s survey).

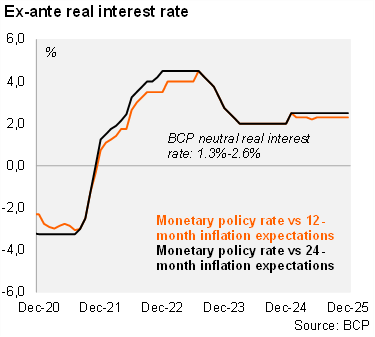

The Committee reaffirmed its commitment to price stability and will continue to closely monitor internal and external developments to anticipate their potential impact on inflation. Additionally, as has frequently been stated, the BCP will take appropriate measures to ensure compliance with the 3.5% target over the monetary policy horizon. Following today’s decision, we estimate that the one-year real ex-ante policy rate remains at 2.5%, towards the upper bound of the BCP’s neutral real interest rate range (1.3%-2.6%).

Furthermore, the committee emphasized the substantial moderation of year-over-year inflation in recent months, indicating reduced fluctuations in the prices of non-food goods and services. In this context, the BCP lowered the 2025 inflation forecast from 4.0% to 3.6% and kept it at 3.5% for 2026. Additionally, stronger growth led the BCP to revise the 2025 GDP growth forecast from 5.3% to 6.0%. For 2026, the monetary authority expects GDP growth of 4.2%. Regarding external factors, the market anticipates further cuts in the Federal Reserve's benchmark rate in 2026. As for commodities, prices have continued to decline over the past month.

Our take: We forecast the policy rate at 6.00% throughout 2026. The policy rate is already at the upper bound of the BCP’s neutral range in real ex-ante terms. Although inflation expectations for the monetary policy horizon (18–24 months) are anchored, economic activity is growing well above its potential (3.5%) and local currency liquidity is at minimum levels. This introduces the risk of higher rates over time. The first monthly monetary policy meeting for 2026 is scheduled for January 23.