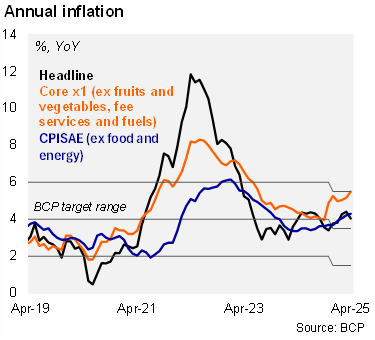

CPI rose by 0.4% MoM in April (from 0.8% a year ago), below our forecast (0.59%) and market consensus (0.5%), according to the BCP survey. Inflation dynamics in the month were mainly characterized by increases in the food basket, especially meat prices (2.9% MoM), partially offset by fruit and vegetables (-2.2% MoM). On the other hand, fuel prices fell by 1.5% MoM, driven by downward adjustments in gasoline. The Core CPI x1 (excludes fruits and vegetables, regulated service prices and fuel) increased by 0.7% (from 0.4% a year ago). On an annual basis, headline inflation fell to 4.0% in April (down from 4.4% in March), while the core X1 CPI stood at 5.5%. We note that both the headline remains within the tolerance band of the BCP’s inflation target (3.5% +/- 2%), while core X1 edged up to the ceiling of the band.

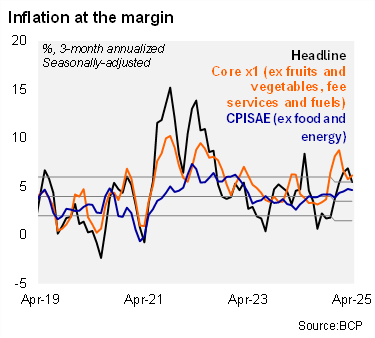

At the margin, headline inflation decelerated, while core inflation accelerated in April. Using our own seasonally adjusted figures, the three-month annualized headline inflation reading fell to 5.5% in April (from 6.9% in March), while core inflation rose to 6.2% (from 5.8% in the previous month).

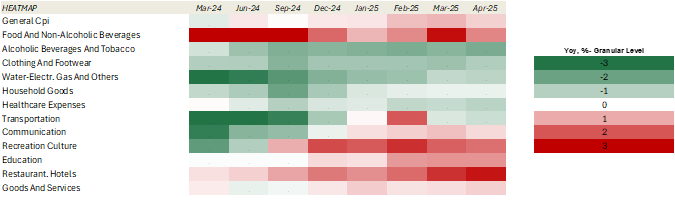

Our heat map shows that 50% of the items are below the central bank's inflation target of 3.5%, which is lower than the end-2024 data (58%).

Our take: Our inflation forecast stands at 4.0% for YE25. Lower commodity prices, in particular oil, should help to decelerate inflation during the rest of the year. The next monthly monetary policy meeting will be held on May 23, while the CPI for May will see the light on June 3.