2025/12/23 | Diego Ciongo & Soledad Castagna

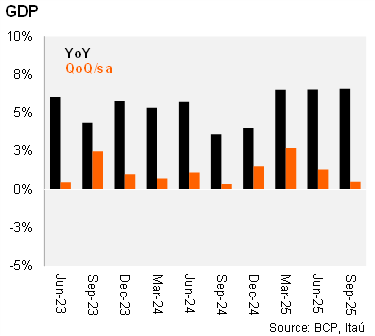

GDP expanded by 6.6% YoY in 3Q25, after growing 6.5% YoY in 2Q25. Looking at the breakdown on the supply side, all sectors expanded on an annual basis, mainly driven by services (+6.9% yoy) led by the commercial sector, manufacturing (+7.4% yoy), the electricity sector (+8.3% yoy) due to greater water flow in the Paraná River and agricultural sector (+9.5% yoy). At the margin, GDP rose 0.5% QoQ/SA in 3Q25, leaving the statistical carryover for 2025 at 5.6%.

Domestic demand improved in 3Q25. Internal demand increased by 5.9% year over year in 3Q25 (from 14.1% in 2Q25) driven by total consumption which expanded by 4.2% yoy (from 2.8% in 2Q25). Private consumption increased by 5.1% yoy, while the public sector declined 1.2% yoy. Furthermore, gross fixed capital investment expanded by 13.1% yoy, led by the increases in investments in construction and in machinery and equipment. External demand had a positive impact; exports of goods and services rose by 10.7% (from -3.1% in 2Q25), due to the positive results in exports of services, machinery and equipment partially offset by lower soybean, electricity and meat sales. Moreover, the imports of goods and services expanded by 8.8% (from 15.1% in 2Q25) led by machinery and equipment and chemical products.

Our take: We see upside risks to our 5.0% GDP growth forecast for 2025 given the higher-than-expected sequential growth in 3Q35.