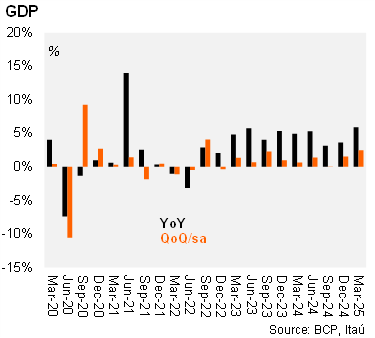

GDP expanded by 5.9% in 1Q25, up from 3.6% in 4Q24. Looking at the breakdown on the supply side, the annual print driven by the positive performances in construction (+12.9% yoy), livestock, forestry and fishing (+10.8% yoy), the electricity sector (+8.3% yoy) due to the recovery of the level of the Paraná river. Manufacturing expanded 6.6% yoy driven by meat, chemical and textile sectors among others. Services expanded by a solid 6.0% yoy led by the commercial sector helped by tourism sector amid positive spillovers from Argentina (stronger ARS). On the other hand, the agricultural sector fell 3.4% yoy affected by a lower soybean harvest due to drought conditions. At the margin, using our seasonally adjusted series, GDP rose sequentially in 1Q25 (2.5% qoq/sa), leaving the statistical carryover for 2025 at 4.1%.

Domestic demand improved in 1Q25. Internal demand increased by 9.3% year over year in 1Q25 (from 10.5% in 4Q24) driven by gross fixed capital formation which expanded 12.7% yoy (from 13.3% in 4Q24). Total consumption expanded by 4.3% yoy, with private sector growth by 4.9% yoy and public by 1.1% yoy. The external demand had a negative contribution. Exports of goods and services rose by a mere 0.2% (from -17.5% in 4Q24), due to lower sales of soybean and electricity. Moreover, the imports of goods and services expanded by 9.0% (from -0.1% in 4Q24) due to higher sales of machinery and equipment and chemical products.

Our take: We revised our GDP growth forecast for 2025 to 4.3% up from 3.5% in our previous scenario mainly due to tracking in 1Q25. On the demand side, we expect private consumption to continue supporting growth helped by the spillovers from Argentina.