2025/11/03 | Diego Ciongo & Soledad Castagna

Consumer prices fell by 0.1% MoM in October, coming in below both the central bank survey and our forecast, marking the second consecutive downside surprise. Declines in vegetables and legumes (-4.2% MoM), fuel prices (-2.3% MoM) and in some imported durable goods (-0.6% MoM) given the recent appreciation of the PYG. However, the increases in food goods prices such as beef meat (1.7% MoM), foods without fruits and vegetables (0.3% MoM) and poultry (0.9% MoM) partly offset reductions. The core CPI X1 (which excludes fruits and vegetables, regulated service prices and fuel) remained stable compared to October (0.0% MoM), down from 0.4% MoM a year ago.

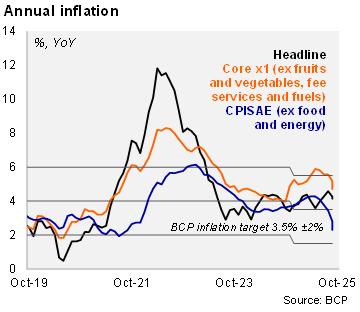

On an annual basis, headline inflation fell to 4.1% in October (down from 4.3% in September), while the core X1 CPI decreased to 4.7% (down from 5.2% in September). Cumulative headline inflation in the year reaches 3.2%. Both headline inflation and core X1 remain within the tolerance range of the BCP’s inflation target (3.5% +/- 2%).

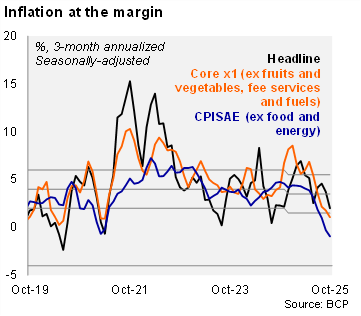

At the margin, both headline and core inflation decelerated in October. Using our own seasonally adjusted figures, the three-month annualized headline inflation reading fell to 2.0% in October (down from 3.7% in September), while core inflation decreased to 1.1%, from 1.8% in the previous month.

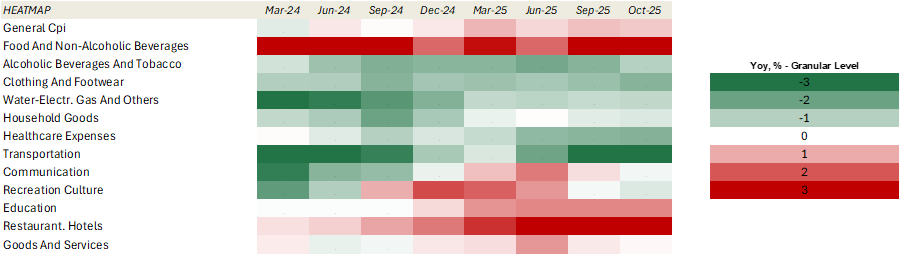

Our heat map shows that 67% of the items are below the central bank's inflation target of 3.5%, up from September 2025 (58%), and higher than the level seen in the end-of-2024 data (58%).

Our take: Our inflation forecast for 2025 stands at 4.2%. The swift appreciation of the PYG since the end of June has eased the pressure on tradable prices which should persist through year-end. November’s CPI will be published on 2 December.