At today's monthly monetary policy meeting, the central bank's Monetary Policy Committee kept the monetary policy rate at 6.00% for the thirteenth consecutive month. The decision was in line with our call and market expectations (according to the BCP's survey).

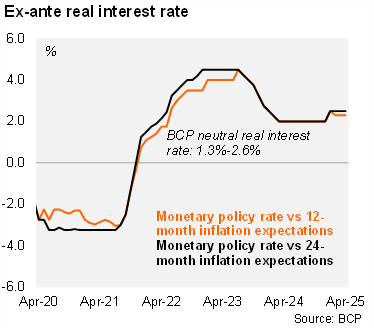

On the domestic front, the statement highlighted the stability of inflation expectations for the monetary policy horizon, which remains at 3.5%, in line with the central bank target. Therefore, we estimate that the real ex-ante policy rate remains at 2.5% (using expectations for the monetary policy horizon), compared to the BCP's neutral real interest rate range of 1.3%-2.6%.

Regarding the global context, the BCP highlighted that the volatility in international financial markets has increased significantly as a result of escalating trade tensions and their potential impact on the global economy. Moreover, international oil prices have declined in the last month, driven by expectations of lower global demand and a more favorable supply outlook. Since the last meeting, soybean and corn prices have increased, while wheat prices have declined.

Our take: Our YE25 policy rate forecast stands at 6.0%. The policy rate is already at the upper bound of the BCP’s neutral range in real ex-ante terms. The next monthly monetary policy meeting is scheduled for May 23.

Our take: Our YE25 policy rate forecast stands at 6.0%. The policy rate is already at the upper bound of the BCP’s neutral range in real ex-ante terms. The next monthly monetary policy meeting is scheduled for May 23.