2025/09/02 | Diego Ciongo & Soledad Castagna

CPI in August rose by 0.1% MoM, well above our forecast (-0.2%) and below the market consensus (0.2%), according to the BCP survey. On a monthly basis, increases in food goods such as beef meat (0.6% MoM) and fruits and vegetables (2.6% MoM); services such as food and beverages consumed outside the home (0.4% MoM) stand out, partially offset by decreases in fuel prices (-2.7% MoM) and in some imported durable goods amid the recent appreciation of the PYG. The core CPI X1 (which excludes fruits and vegetables, regulated service prices and fuel) rose by 0.2% MoM in August, which remain stable from a year ago (0.2% MoM in August 2024).

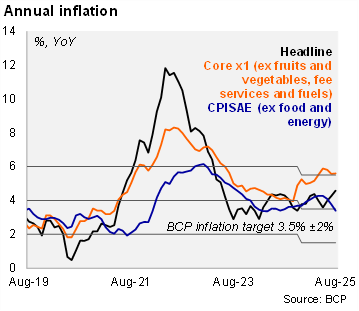

On an annual basis, headline inflation rose to 4.6% in August (up from 4.3% in July), while the core X1 CPI remained at 5.6%. We note that headline inflation on an annual basis remains within the tolerance range of the BCP’s inflation target (3.5% +/- 2%), while core X1 remains slightly above it.

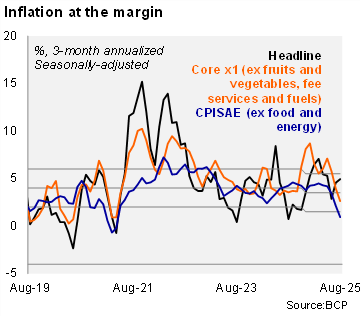

At the margin, headline inflation accelerated, while core inflation decelerated in August. Using our own seasonally adjusted figures, the three-month annualized headline inflation reading rose to 4.9% in August (up from 4.6% in July), while core inflation fell to 2.6% (from 4.0% in the previous month).

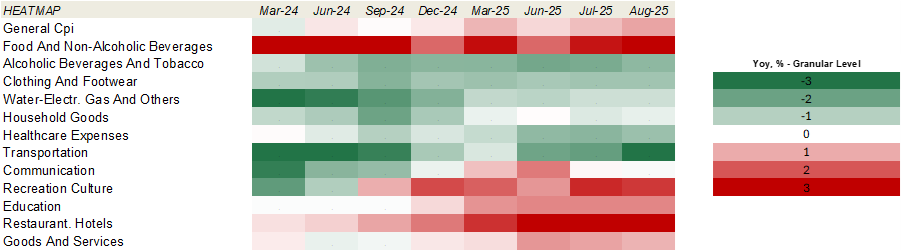

Our heat map shows that 58% of the items are below the central bank's inflation target of 3.5%, up from 50% in July 2025, and the same level seen in the end-of-2024 data.

Our take: Our inflation forecast stands at 4.0% for YE25, now with upside risks due to another higher-than-expected print in August. The recent appreciation of the PYG should moderate pressure on tradable prices, while lower commodity prices, particularly oil prices, will also play a key role in the remainder of the year. The next monthly monetary policy meeting will be held on September 23, while the CPI for September will see the light on October 2.