2026/02/03 | Diego Ciongo & Soledad Castagna

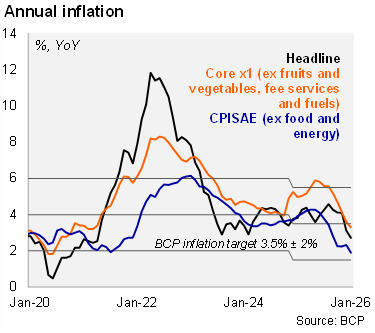

CPI rose by 0.6% MoM in January, below our forecast (0.7%) but above the market consensus (0.3%). At the margin, inflation was driven by food prices, particularly in vegetables and legumes (+28.4% MoM) and meat (2.0% MoM). On the other hand, fuel prices declined (-1.0% MoM), in line with international crude price dynamics in recent months, while import goods prices declined 0.4% MoM, likely due to the appreciation of the PYG. Core CPI x1 (excludes fruits and vegetables, regulated service prices and fuel) stood at 0.3% MoM (from 0.6% a year ago). On an annual basis, headline inflation fell to 2.7% in January from 3.1% in YE25, while core X1 CPI decreased to 3.3% from 3.6%. We note that both the headline and the core remain within the tolerance band of the BCP’s inflation target (3.5% +/- 2%).

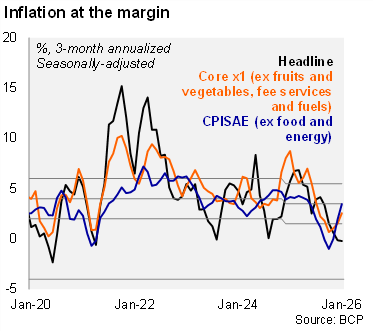

At the margin, headline and core inflation were mixed. Using our seasonally adjusted estimates, the three-month annualized headline inflation reading fell to -0.2% in January (from -0.1% in December), while core inflation rose to 2.6% (from 1.5% in the previous month).

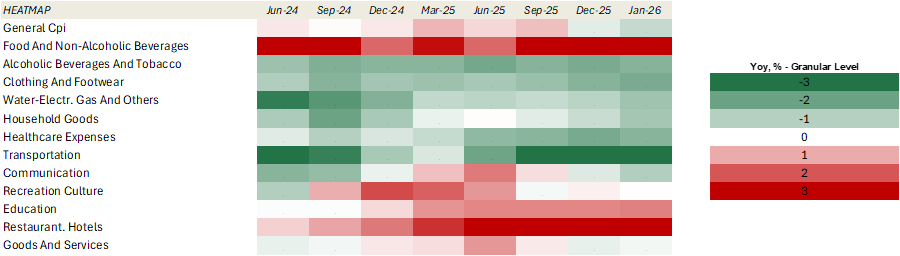

Our heat map shows that 67% of the items are below the central bank's 3.5% inflation target, unchanged from the previous month's figure, but higher than the figures registered in the same month of 2025 (42%).

Our take: We foresee inflation reaching 3.5% by YE26, which is in line with the central bank’s target range. The recent reduction in fuel prices, coupled with a stronger PYG against the USD, should moderate inflation in the coming months, resulting in low year-over-year readings (an average of 2.5% in 1Q26). February's CPI will be published on March 4. Low inflation and anchored inflation expectations may allow the central bank to continue the easing cycle started in January.