2025/12/30 | Diego Ciongo & Soledad Castagna

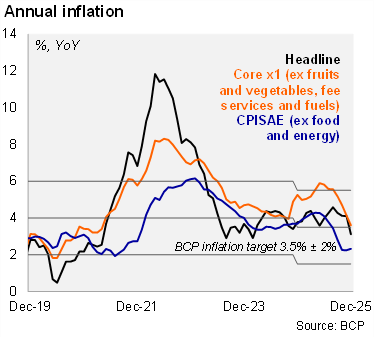

CPI fell by 0.3% MoM in December, below our forecast (0.1%) and the market consensus (0.3%). At the margin, inflation was driven by food price declines, particularly in vegetables and legumes (-12.6% MoM), which, in turn are likely due to positive supply shocks from favorable climatic conditions. Additionally, fuel prices declined (-3.3% MoM), in line with international crude price dynamics in recent months. However, increases in services offset the declines observed in December. Core CPI x1 (excludes fruits and vegetables, regulated service prices and fuel) stood at 0.2% MoM (from 0.7% a year ago). On an annual basis, headline inflation fell to 3.1% in December, while core X1 CPI decreased to 3.6% from 4.1%. We note that both the headline and the core remain within the tolerance band of the BCP’s inflation target (3.5% +/- 2%).

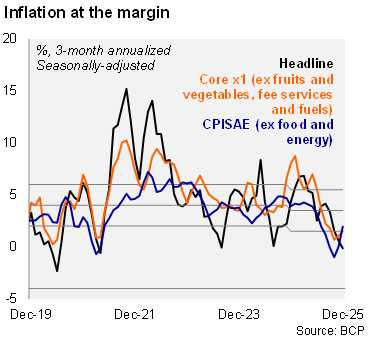

At the margin, headline inflation decelerated while core accelerated. Using our own seasonally adjusted figures, the three-month annualized headline inflation reading fell to -0.1% in December (from 0.6% in November), while core inflation rose to 1.5% (from 1.0% in the previous month).

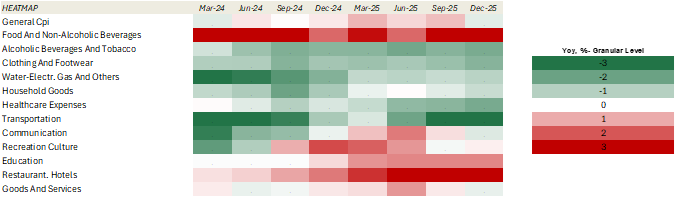

Our heat map shows that 67% of the items are below the central bank's revised inflation target of 3.5%, below the previous month's figure (75%), but higher than the figures registered at the end of 2024 (58%).

Our take: We expect inflation to remain within the central bank's target (3.5% +/- 2%) during 2026 and forecast 3.5% by the end of the year. The swift and significant appreciation of the PYG (~17% since late June) is likely to moderate pressure on tradable inflation, while persistently stronger than expected activity may exert opposing pressure on non-tradables.