2025/10/27 | Julia Passabom & Mariana Ramirez

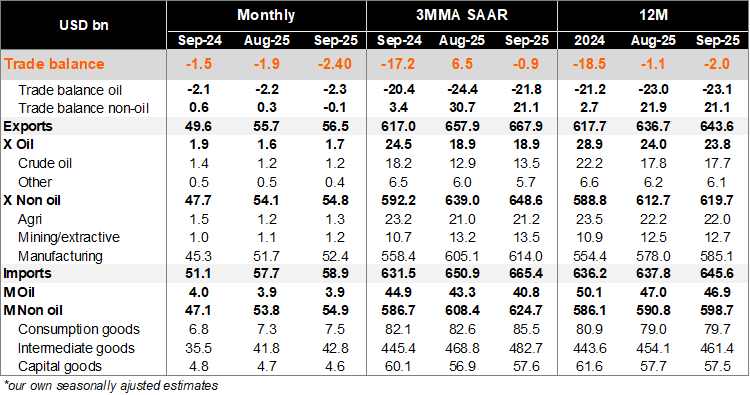

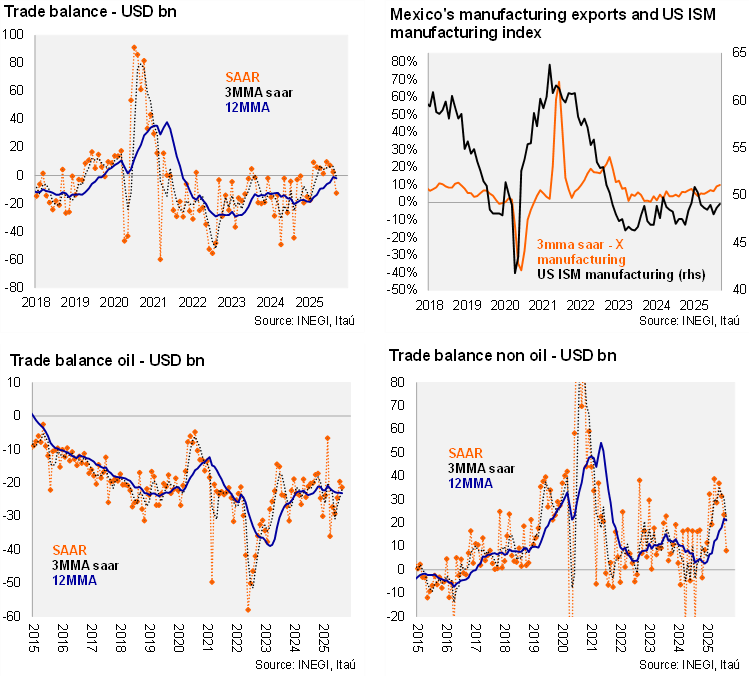

September’s trade balance revealed a goods deficit of USD 2.4 billion, which was far greater than the Bloomberg’s market consensus of a USD 500 million deficit and worse than September 2024’s deficit of USD 1.5 billion. On a 12-month rolling basis, the goods trade deficit increased to USD 2.0 billion, from a USD 1.1 billion deficit in August. At the margin, using three-month annualized seasonally adjusted figures, the trade balance showed some deterioration after recent strong figures, now indicating a deficit of USD 900 million (down from a USD 6.5 billion surplus in August). Examining the breakdown on a 12-month rolling basis, the oil trade balance continued to show a deficit (USD 23.1 billion deficit compared to a USD 21.1 billion surplus for non-oil), following the decline in domestic oil production and the government's strategy to prioritize domestic oil refineries.

Our view: The worse-than-expected trade balance in September followed a series of strong external data. Today’s release showed imports increasing at the margin, while exports remain robust, especially in the non-auto manufacturing sector this month. Net exports is an important driver of economic growth in 3Q25, though less so than in 1Q25. Uncertainty surrounding Mexico’s trade relationship with the US will continue to challenge trade flows until a definitive USMCA renegotiation begins before July 1, 2026. Looking ahead, oil exports will be influenced by domestic policies related to national sovereignty and oil price dynamics, while manufacturing exports are expected to continue at high levels.

See detailed data below