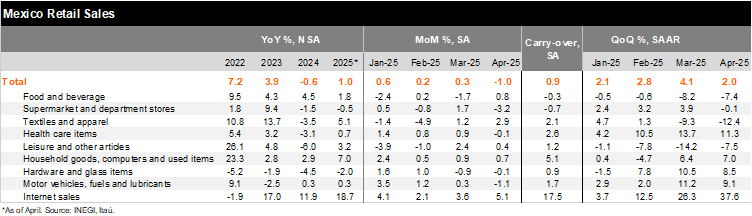

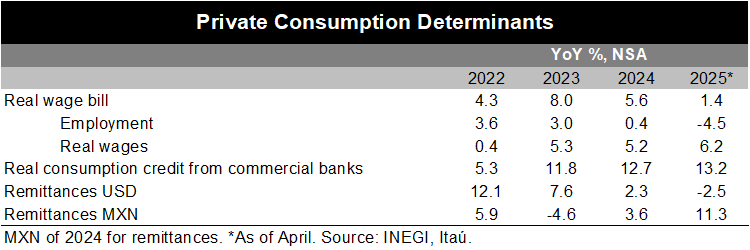

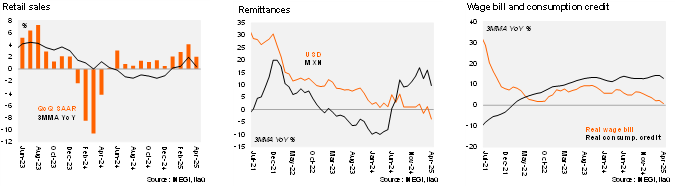

Retail sales declined by 2.0% YoY in April, surprising analysts who had predicted an annual contraction of 0.4%, according to the Bloomberg median. This surprise occurred in the context of a calendar shift, as the Holy Week vacation was in March in 2024, while this year it took place in April. Adjusting for calendar effects, retail sales fell by 1.0% MoM, falling far greater than the consensus forecast of 0.1% growth. Five out of nine subsectors grew in April, with internet sales up by 5.1%, textiles and apparel by 2.9%, and household goods by 0.7%. However, supermarkets and department stores, as well as motor vehicles, experienced contractions of 3.2% and 1.1% MoM, respectively. Despite these results, we still identify positive private consumption determinants, with the real wage bill rising by 1.4% YoY, and real consumption credit from commercial banks and remittances in MXN at 13.2% and 11.3%, respectively.

Our take: Today’s survey-based retail sales data is sourced from revenues from companies, which explains the difference from IGAE’s figures that estimate value added. Today’s results still have a positive bias, with the QoQ/SAAR at 2.0% (down from +4.1% in the previous quarter) and a statistical carry-over of 0.9% for the year. Due to resilient consumption determinants, such as the growing real wage bill and still historically high consumer confidence, we anticipate the sector will remain slightly positive in 2025. Additionally, we expect private consumption to be the main driver of GDP growth this year.