2025/09/23 | Julia Passabom & Mariana Ramirez

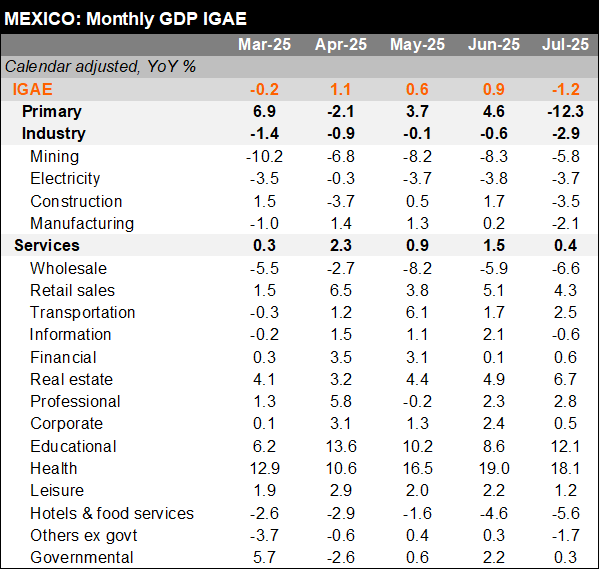

Economic activity fell by 1.1% YoY in July, a deeper contraction than both Bloomberg’s market consensus and our forecast (-0.5% and -0.9%, respectively). After adjusting for calendar effects, activity contracted by 1.2%, driven by the negative performance of agriculture (-12.3%, the steepest annual contraction since January 2024) and industry (-2.9%, marking five consecutive decreases with a broad-based decline across subsectors during the month). The calendar-adjusted contraction occurred despite growth in services (+0.4%, with 10 out of 14 subsectors showing growth).

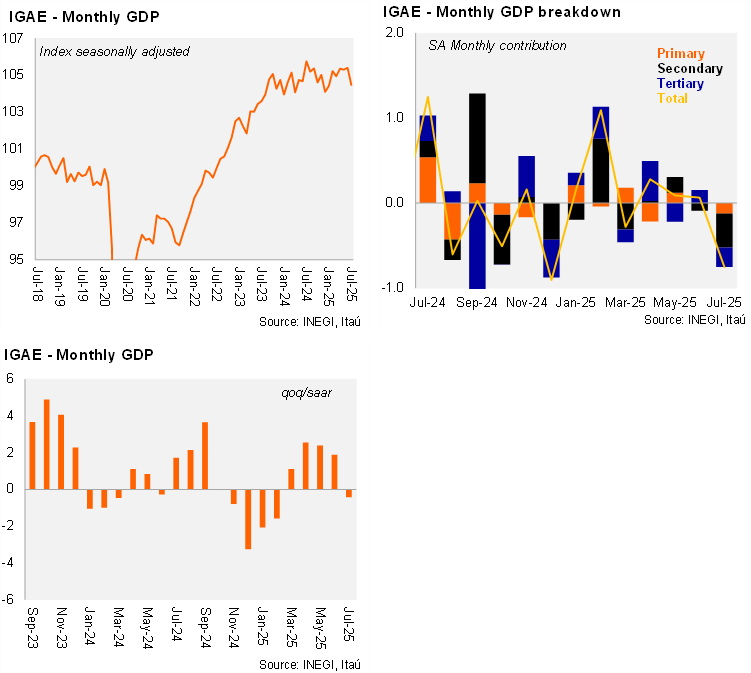

When considering seasonally adjusted figures, the economy contracted by 0.9%, a greater decline than the IGAE nowcast of -0.5% MoM but closer to our forecast of -0.7%. By sector, industrial production declined by 1.2% MoM due to downturns in construction, manufacturing, and utilities. Primary activities decreased by 3.0% MoM, following a flat performance in June. Services decreased by 0.4%, with negative performances in 9 out of 14 subsectors, including retail sales, transportation, leisure, and hotels and restaurants.

Our view: Today’s figures showed a quarterly negative bias at the beginning of the third quarter, with the QoQ/SAAR at -0.4% due to industry and agriculture. The carry-over for 2025 is flat; however, leading indicators for August suggest a better outlook for the quarter. Looking ahead, we expect the economy to continue decelerating on an annual basis, as the government remains focused on strengthening domestic activity amid changes in the global outlook. We forecast GDP growth of 0.6% in 2025.

See details below