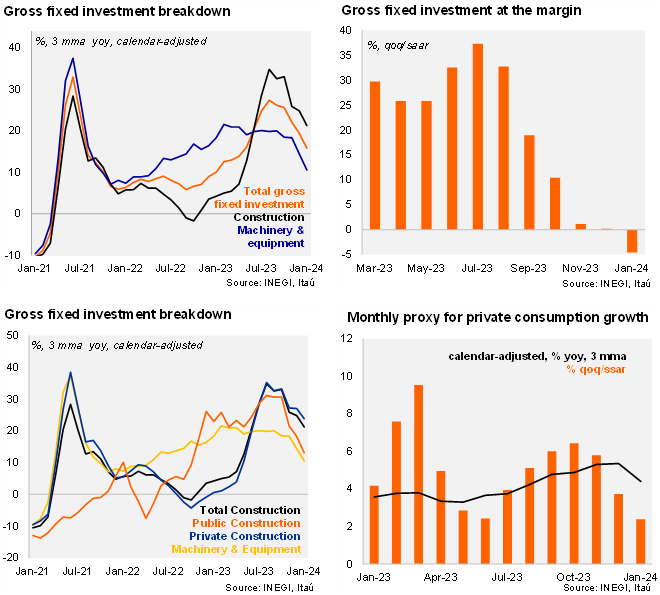

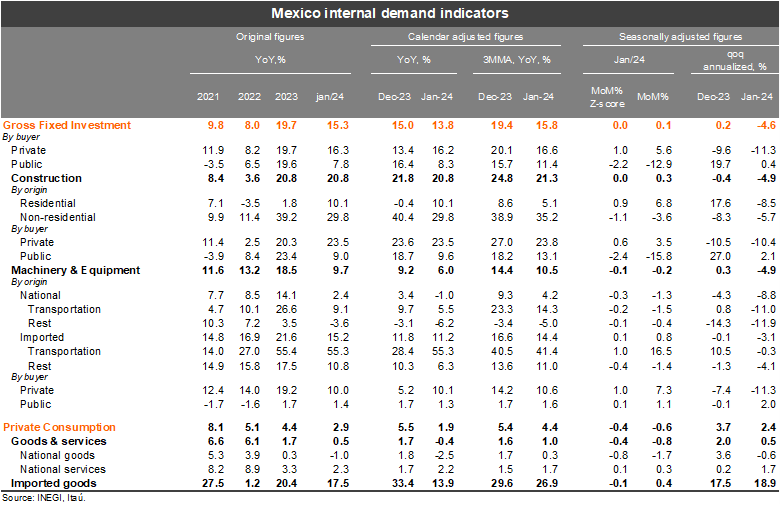

Gross Fixed Investment (GFI) expanded 15.3% yoy in January (vs. market consensus of 17.9%), while private consumption rose by 2.9% (vs. market consensus of 3.7%). Adjusting for working days, GFI grew at a slower pace (13.8%), taking the quarterly annual rate to 15.8% in January (from 19.4% in 4Q23). Using the seasonally adjusted series, GFI expanded at a soft 0.1% MoM/SA in January, with weak public construction, and machinery & equipment investment softening. The qoq/saar of GFI stood at -4.6% in January (down from 0.2% in 4Q23). Using calendar adjusted figures, private consumption’s quarterly annual growth rate stood at 4.4% in January (from 5.4% 4Q23). At the margin, private consumption fell by 0.6% MoM/SA, with momentum softening although still positive (2.4% in January, from 3.7% in 4Q23).

Our view: The soft internal demand print in January is consistent with the weak monthly GDP indicator, despite strong fiscal spending. Our GDP growth of 2.8% for 2024 has a downside bias. Soft activity at the beginning of the year should give Banxico some comfort to continue cutting its policy rate, assuming the disinflationary process progresses further (particularly in services inflation). Our base case remains for Banxico to cut its policy rate by 25-bp in each of the monetary policy meetings of the year, reaching an end of year level of 9.50%.

See detailed data below