2025/09/26 | Julia Passabom & Mariana Ramirez

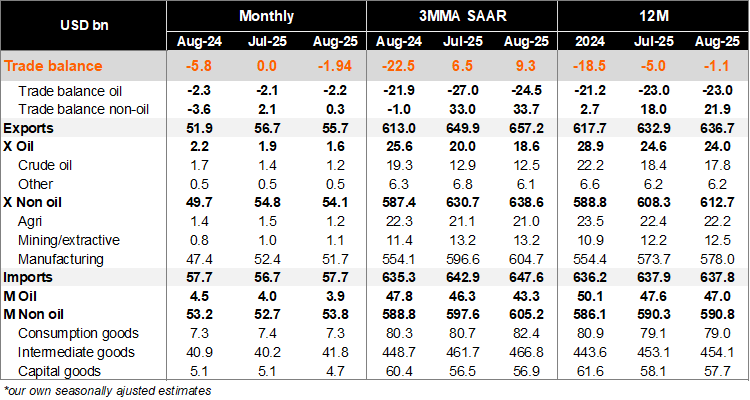

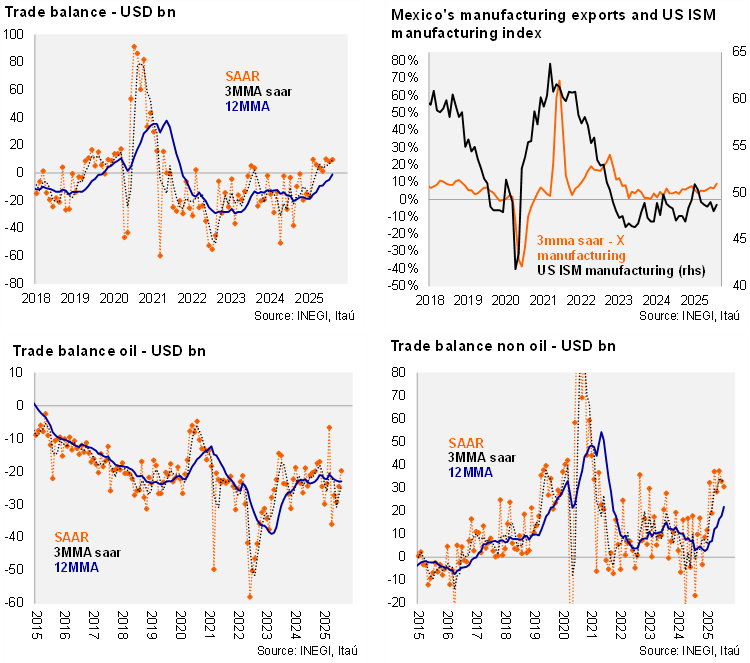

August’s trade balance revealed a goods deficit of USD 1,944 million, below Bloomberg’s market consensus of a USD 2.6 billion deficit and an improvement from August 2024’s deficit of USD 5,845 million. On a 12-month rolling basis, the goods trade deficit reached USD 1.1 billion, from a USD 5.0 billion deficit in July. At the margin, using three-month annualized seasonally adjusted figures, the trade balance continued to improve, now showing a surplus of USD 9.3 billion (up from a USD 6.5 billion surplus in July). Examining the breakdown on a 12-month rolling basis, the oil trade balance continued to show a deficit (USD 23.0 billion deficit compared to a USD 21.9 billion surplus for non-oil), following the decline in domestic oil production and the government's strategy to prioritize domestic oil refineries.

Our view: The August trade balance continued to highlight the strength of Mexico’s external accounts amid tariff-related uncertainty, with some signs of persistent front-loading in exports. Net exports remain an important driver of economic growth in 3Q25, though less so than in 1Q25. Capital goods imports showed some marginal improvement, signaling a modest rebound in investments. Uncertainty surrounding Mexico’s trade relationship with the US will continue to challenge trade flows until a definitive USMCA renegotiation begins before July 1, 2026. Looking ahead, oil exports will be influenced by domestic policies related to national sovereignty and oil price dynamics. Weaker internal demand and a slowdown in construction are likely to limit non-energy consumption, particularly for non-residential projects.

See detailed data below