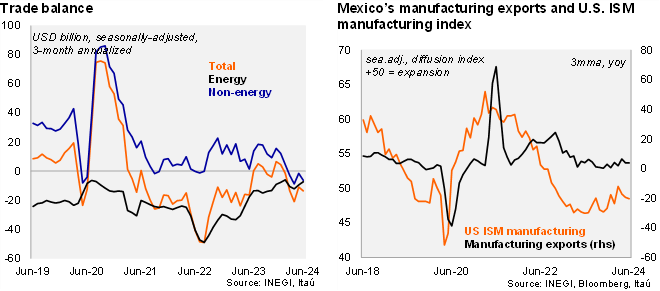

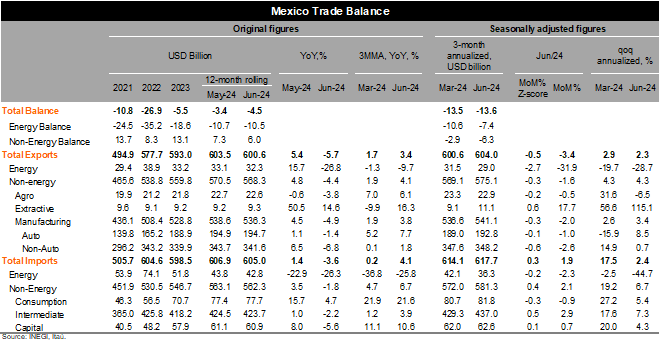

The trade balance surprised with a deficit of USD 1.0 billion in June, below market consensus of a surplus of USD 0.6 billion (as per Bloomberg) and our call of a surplus of USD 2.1 billion. On a 12-month rolling basis, the trade deficit reached USD 4.5 billion in June (from a deficit of USD 3.4 billion in May and a deficit of USD 5.5 billion in 2023). The result is explained by a smaller non-energy trade surplus, while the energy trade deficit stood practically unchanged. At the margin, using three-month annualized seasonally adjusted figures, the trade balance stood at a deficit of USD 13.6 billion in 2Q24 (practically unchanged from the 1Q24). Looking at the breakdown, manufacturing exports weakened, falling by 2.0% MoM/SA in June despite the depreciation of the currency after elections, but with a positive momentum (qoq/saar of 3.4%). Non-energy imports expanded 2.1% MoM/SA in June supported by intermediate imports, while consumption and capital imports were soft. The qoq/saar of non-energy imports stood at 6.7%.

Our view: Our trade deficit forecast for 2024 stands at USD 10 billion. A weaker currency, generated by post-election policy uncertainty, will bring some support to manufacturing exports during the rest of the year. Weaker internal demand outlook will likely curb non-energy consumption and capital imports.

See detailed data below