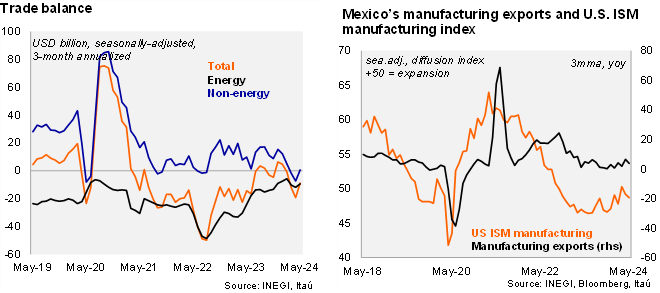

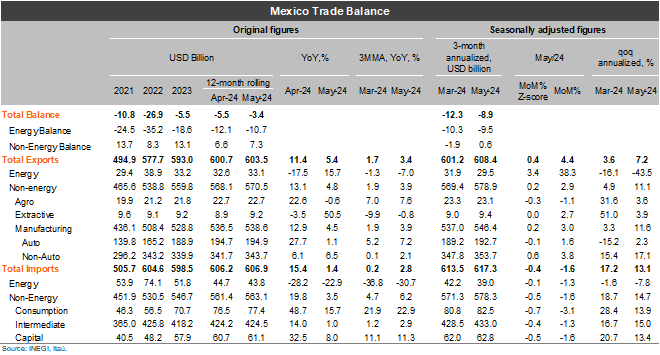

The trade balance surprised with a surplus of USD 1.9 billion in May, significantly above market consensus of a deficit of USD 2.1 billion (as per Bloomberg) and our forecast of a deficit of USD 2.2 billion. On a 12-month rolling basis, the trade deficit reached USD 3.4 billion in May (from a deficit of USD 5.5 billion in April and a deficit of USD 5.5 billion in 2023). The result is explained by a smaller energy trade deficit and a wider non-energy surplus. At the margin, using three-month annualized seasonally adjusted figures, the trade balance stood at a deficit of USD 8.9 billion in May (from a deficit of USD 12.3 billion in 1Q24). Looking at the breakdown, manufacturing exports posted a strong expansion of 3.0% MoM/SA in May, with a positive momentum (qoq/saar of 11.6%). Non-energy imports weakened, falling by 1.6% MoM/SA in May, dragged by all - consumption, intermediate and capital imports. However, non-energy imports momentum remained positive, with the qoq/saar at 14.7%.

Our view: Our trade deficit forecast of USD 14 billion for 2024 has an upward bias (narrower deficit), after today’s figures. We expect the recent depreciation of the currency, generated by greater post-election policy uncertainty, to support manufacturing exports. Internal demand is likely to soften in the 2H24, as fiscal expenditure slows, which will likely curb consumption and capital non-energy imports.

See detailed data below

Julio Ruiz