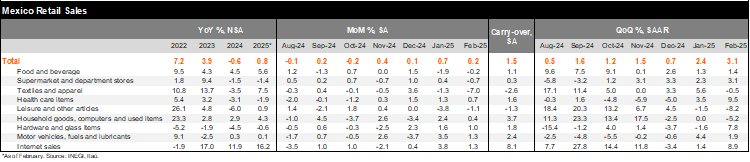

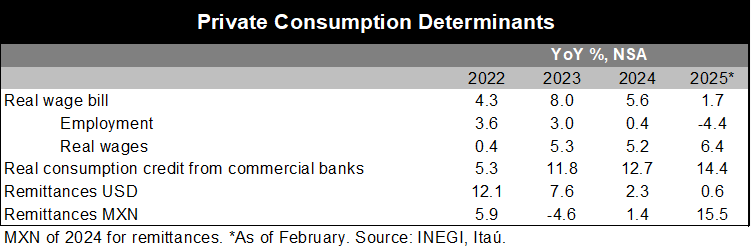

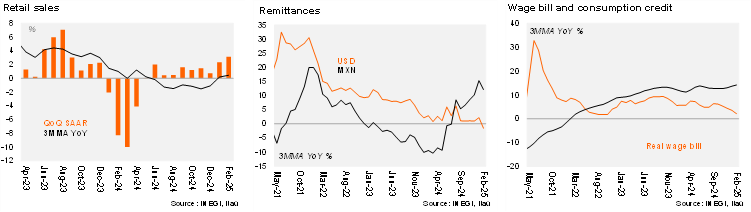

Retail sales fell by 1.1% YoY in February, surprising analysts who had predicted a 0.1% decrease, according to Bloomberg’s median survey. On a monthly basis, using seasonally adjusted figures, retail sales rose by 0.2%, close to the consensus forecast of a -0.1% contraction. Five out of nine subsectors saw growth, with motor vehicles up by 1.3%, hardware by 1.0%, and internet sales by 1.3%. Textiles and apparel, on the other hand, were down by 7.0% compared to January, indicating heterogeneity across the items. Most private consumption determinants remain supportive, with the YTD real wage bill at 1.7% as of February, while real consumption credit from commercial banks and remittances in MXN stood at 14.4% and 15.5%, respectively.

Our take: Consumption continued to growth positively at the beginning of 2025, with QoQ/SAAR at 3.1% (up from 2.4% in the previous quarter) and a statistical carry-over of 1.5%. Due to resilient consumption determinants, such as rising real wages, historically high consumer confidence, and increasing consumer credit, we anticipate the sector will remain slightly positive in 2025. Additionally, we expect private consumption to be the main driver of GDP growth this year, despite our forecast of a 0.5% YoY GDP contraction in 2025.

See detailed data below