2025/08/25 | Julia Passabom & Mariana Ramirez

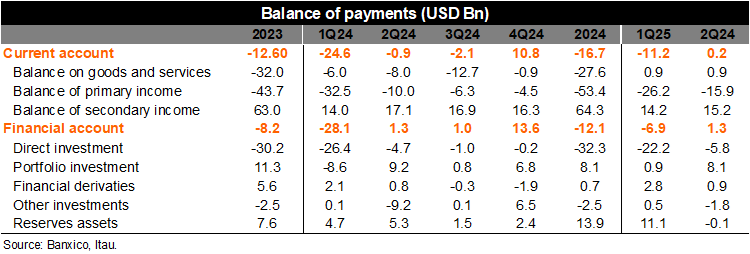

The current account posted a surplus of USD 0.2 billion in 2Q25, which was lower than Bloomberg's market consensus of USD 5.4 billion. Compared to 2Q24, the current account balance reflected a surplus in the trade balance due to non-oil merchandise, reduced remittances (likely due to immigration-related uncertainty) and potential changes in remittance regulations), and higher outflows in dividends and interest. As a result, the current account was flat as a percentage of GDP, compared to -0.2% in 2Q24. Historical data was revised as part of the review process of published information. The main revisions were to data on petroleum product imports, crude oil export figures, and agricultural goods export data. For petroleum product imports, statistical revisions reflected extraordinary modifications to historical customs clearance documents based on the "Law of the State-Owned Enterprise, Petróleos Mexicanos," published in the Official Gazette of the Federation on March 18, 2025.

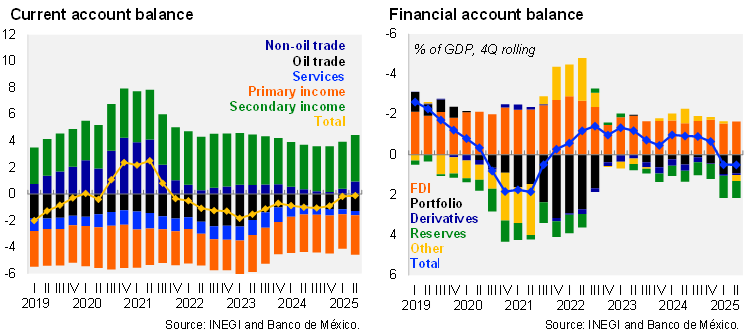

On the other hand, the financial account registered a net loan flow of USD 1.3 billion in 2Q25. By account, the net balance of the direct investment account was USD 5.8 billion, while portfolio investment had a net inflow of USD 8.1 billion, and reserve assets accounted for USD -0.1 billion. Financial derivatives posted a net inflow of USD 0.9 billion. Finally, the errors and omissions account closed the balance of payments with a net balance of USD 1.052 billion. Consequently, the financial account amounted to 0.3% of GDP.

Our view: Amid shifts in U.S. trade policy, we expect uncertainty and volatility to persist throughout the year, impacting the balance of payments in 2025. We anticipate that investment decisions will likely adopt a wait-and-see approach for some time, affecting FDI during the year. Our 2025 current account deficit forecast stands at 0.6% of GDP, with a trade deficit of USD 10 billion.

See details below