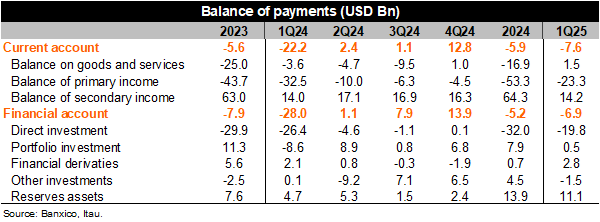

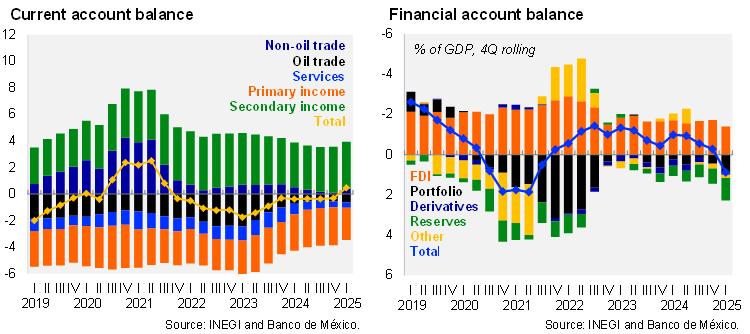

The current account posted a deficit of USD 7.6 billion in 1Q25, a lower deficit than the Bloomberg’s market consensus of USD 16.2 million deficit and the 1Q24 deficit (USD -22.2 bn). Compared to 1Q24, the current account balance reflected a surplus within the trade balance, as well as slightly more remittances, and lower outflows in dividends and interests. As a result, the current account was equivalent to -1.8% of GDP vs -4.7% in 1Q24.

On the other hand, the financial account registered a net debt flow of USD 6.9 bn in the 1Q25. By accounts, the net balance of the direct investment account was around USD 20 bn, while portfolio investment had a net inflow of USD 0.5 bn, and reserve assets accounted for USD 11.1 bn. Financial derivatives posted a net inflow of USD 2.8 bn. Finally, the errors and omissions account closed the balance of payments with a net balance of USD 753 million. Consequently, the financial account resulted in 0.9% of GDP.

Our view: In the context of shifts in the US’ trade policy, we expect uncertainty and volatility to persist during the year and impact the balance of payments in 2025. For instance, we anticipate that investment decisions are likely to take a wait-and-see approach for some time, affecting FDI at least in the first half of 2025. Our current account forecast for 2025 is a deficit of 0.6% of GDP, with a trade deficit of USD 10 bn.

See details below