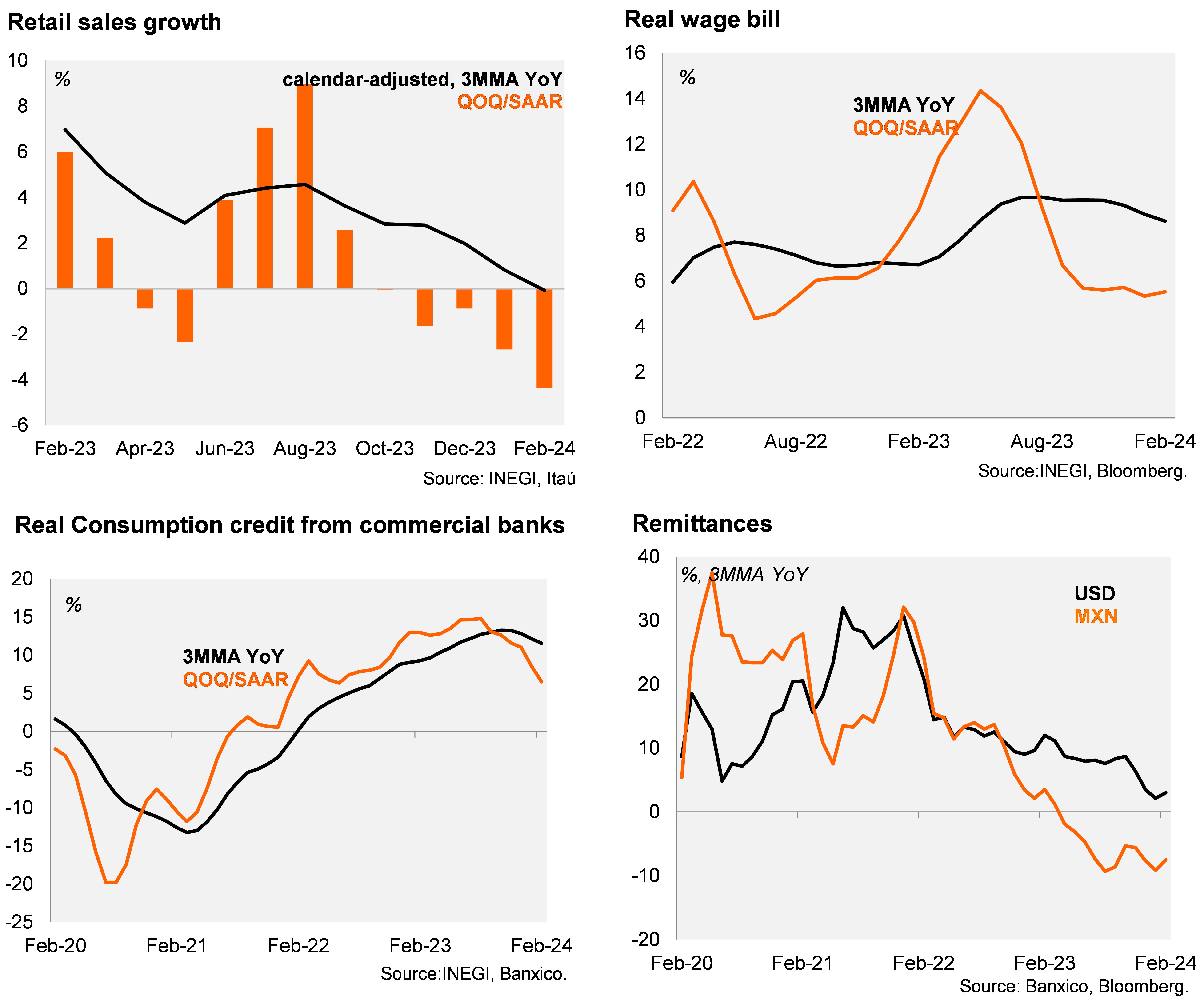

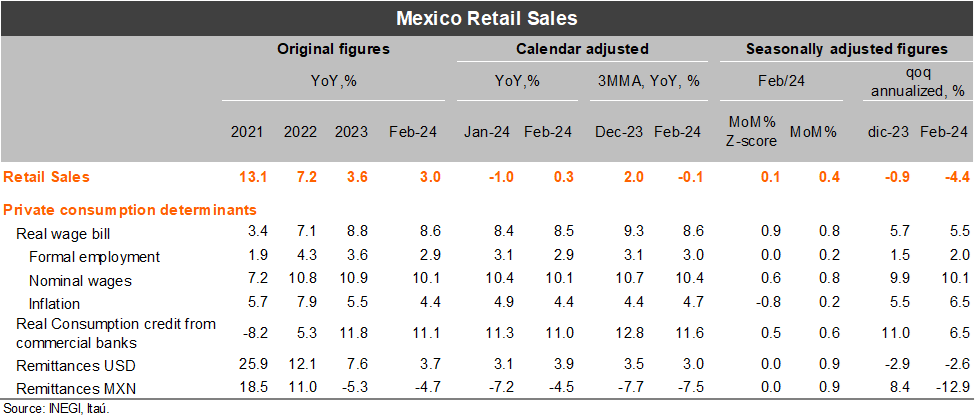

Retail sales increased by 3.0% YoY in February, above our forecast of 1.9% and market expectations of 1.8% (as per Bloomberg). The headline figure was boosted by a favorable calendar base effect (leap year). In fact, using calendar adjusted figures, retail sales expanded 0.3% YoY in February (from -1.0% in January), taking the quarterly annual rate to -0.1% (from 2.0% in 4Q23). Using seasonally adjusted series, retail sales expanded at a decent 0.4% MoM/SA but with momentum remaining weak (qoq/saar of -4.4% in February, from -0.9% in 4Q23). Most private consumption determinants remain supportive (although slowing at the margin), with the qoq/saar of the real wage bill at 5.5% in February (from 5.7% in 4Q23), while real consumption credit from commercial banks and remittances in MXN stood at 6.5% (from 11.0%) and -12.9% (from 8.4%), respectively.

Our take: The recovery in retail sales suggests the strong fiscal spending at the start of the year is starting to show in activity data. Despite the positive surprise, we have maintained our downside bias on our 2024 GDP growth call of 2.8%. Next week, on Monday, we will have more information with the February's monthly GDP. While soft activity at the beginning of the year amid falling core inflation seem conducive for another rate cut in May, we think Banxico will likely pause (keeping the policy rate at 11.00%) given the Fed repricing pointing to a delay in the beginning of their easing cycle. Our end of year policy rate forecast is at 9.75%.

See detailed data below

Julio Ruiz