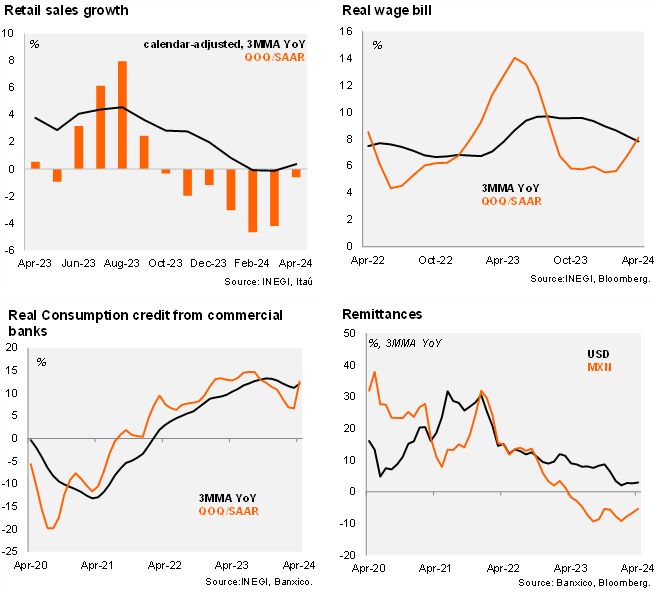

Retail sales increased by 3.2% YoY in April, above our forecast of 1.6% and market expectations of 1.0% (as per Bloomberg). The headline figure was boosted by a favorable calendar base effect (Easter Holidays). In fact, using calendar adjusted figures, retail sales expanded 0.4% YoY in April, taking the quarterly annual rate to 0.4% in April (from -0.1% in 1Q24). Using seasonally adjusted series, retail sales expanded at a decent 0.5% MoM/SA but with momentum remaining weak, although improving (qoq/saar of -0.6% in April, from -4.2% in 1Q24). Most private consumption determinants remain supportive, with the qoq/saar of the real wage bill at 8.1% in April (from 6.8% in 1Q24), while real consumption credit from commercial banks and remittances in MXN stood at 12.6% (from 6.7%) and -7.5% (from -14.8%), respectively.

Our take: The expansion in April’s retail sales is likely supported by an expansionary fiscal stance concentrated in the 1H24. However, we expect activity to slow in the 2H24 as fiscal expenditure softens after elections and amid the transition between administrations. The recent depreciation of the currency, associated to political uncertainty, is likely to mitigate the slowdown in activity, boosting remittances in MXN (a relevant determinant for private consumption). Tomorrow we will have the monthly GDP for the month of April which will give us a clearer view of the state of the economy. Our GDP growth forecast for 2024 stands at 2.3%.

See detailed data below

Julio Ruiz