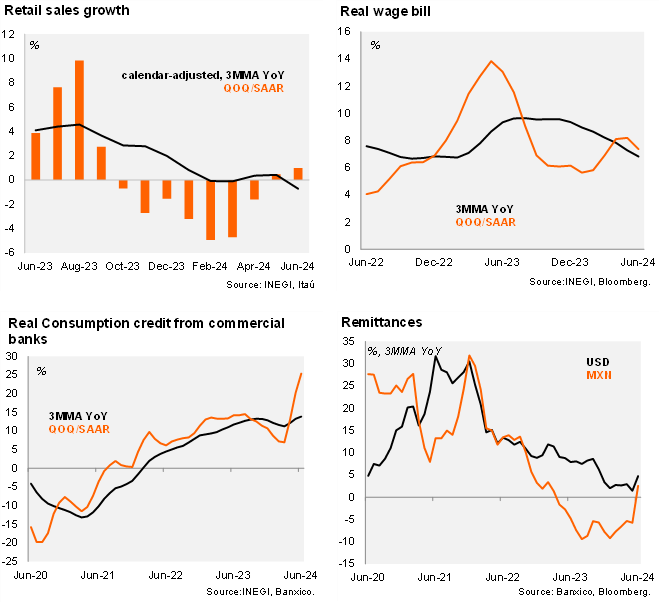

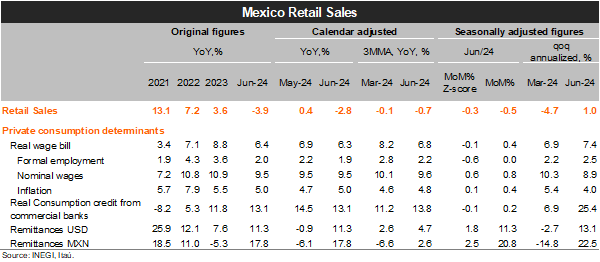

Retail sales fell by 3.9% YoY in June, below market consensus of -2.0% (as per Bloomberg), although closer to our call of -3.4%. Using calendar adjusted figures, retail sales fell by at a slower pace (-2.8%), taking the 2Q24 annual rate to -0.7 (from -0.1% in 1Q24). Using seasonally adjusted series, retail sales fell by 0.5% MoM in June, with the qoq/saar at a soft 1.0% in 2Q24. The real wage bill, the main private consumption determinant, remains supportive with the qoq/saar at 7.4% in 2Q24 (from 6.9% in 1Q24), while real consumption credit from commercial banks stood at 25.4% (from 6.9%). Remittances in MXN qoq/sar improved to 22.5% in 2Q24 (from -14.8% in 1Q24) boosted mainly by the recent depreciation of the currency.

Our take: Today’s retail sales data is consistent with a slowdown of economic activity in 2Q24. This Thursday's national accounts figure for the 2Q24 will be released which will likely confirm soft activity (our 2024 GDP growth forecast is at 1.6%). In this context, and amid a lower core inflationary gap and higher odds of the Fed starting its easing cycle in September we think Banxico will continue cutting its policy rate by 25-bp in each of the remaining meetings of the year (our end of year policy rate forecast is at 10.00%).

See detailed data below