2025/09/01 | Julia Passabom & Mariana Ramirez

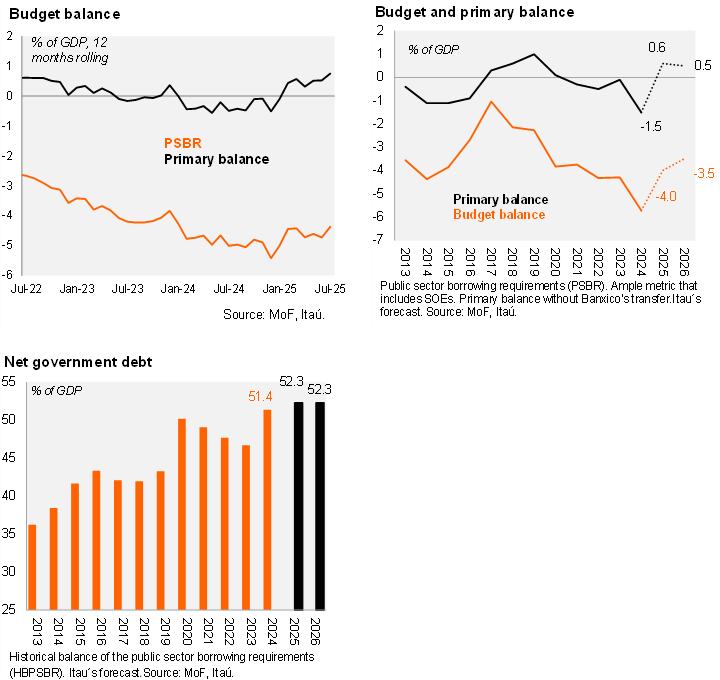

The Ministry of Finance (MoF) released its public finance report as of July. On a 12-month rolling basis, the broadest measure of the public balance (PSBR) posted a deficit of 4.4% of GDP through July, while the primary public balance swung to a surplus of 0.8% of GDP. During the first seven months of the year, real revenues rose by 3.3% YoY, supported by higher-than-expected import taxes and VAT revenues, despite a significant contraction in Pemex oil revenues amid decreasing oil production. On the other hand, total expenditure contracted by 3.8% YoY in real terms, primarily due to lower administrative expenses and capital investment, despite a 6.2% YoY real growth in direct budget control agencies (social security agencies: IMSS and ISSSTE). Finally, net government debt stood at 49.7% of GDP, below the MoF’s 2025 forecast of 52.3% and the previous year figure of 51.3%.

Our view: July figures indicate that the pace of revenue improvement continues to slow. Expenditures declined, reaching 94.7% of the budget as of July, primarily due to cuts in public investment. The administration will present the 2026 budget on September 8th. We expect that the MoF will include more support for Pemex, as well as a downward adjustment to current GDP estimates for 2025 and 2026, which could also imply revising the fiscal deficit forecast from a range of 3.2-3.5% of GDP in 2026. We also anticipate that the reduction in expenditure on public infrastructure projects could be reversed in 2026.

See more details below