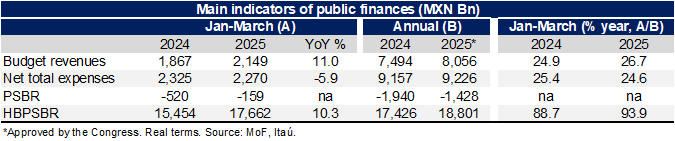

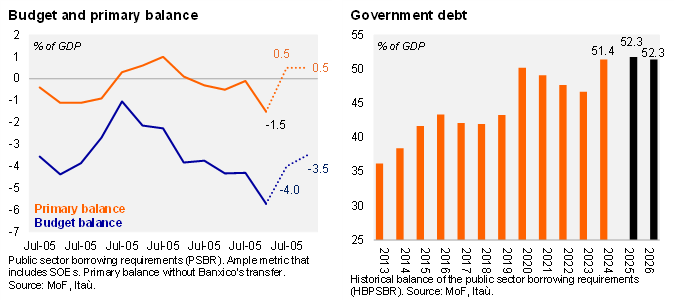

The Ministry of Finance (MoF) released its public finance report for March. On a 12-month rolling basis, the broadest measure of the public balance (PSBR) posted a deficit of 0.38% of GDP in 1Q25, while the primary public balance showed a surplus of 0.1% of GDP. This result was mainly due to a 5.9% YoY real contraction in total expenditure, primarily from lower operating expenses, despite an 11.3% YoY real growth in expenses to state public enterprises (Pemex and CFE). On the income side, some seasonal distortions were present, with a scheduling effect related to the last business day for the final payment of taxes by legal entities, which in 2024 was extended until April. Real revenues rose by 11.0% YoY, supported by higher-than-expected import tax and VAT revenues, despite a significant contraction in Pemex oil revenues amid decreasing oil production. Government debt increased by 10.3% YoY, mainly due to external debt.

Regarding the operating surplus of 0.05% of GDP that Banxico will deliver to the MoF, derived from foreign exchange and operating profits of the 2024 fiscal year, the MoF explained that the transfer of these resources is mandated by law (70% of the revenues must be used to amortize government debt, while the remainder will contribute to stabilization funds). Additionally, the MoF has until January 2026 to disclose how they will use that money.

Our view: Despite a decrease in total expenses as of March, financial support to Pemex and CFE continued to rise. Additionally, budget revenues increased in the first quarter of the year, but maintaining this growth is challenging due to the forecasted economic slowdown and challenges from the international environment. For 2025, we anticipate fiscal consolidation with a nominal deficit of 4.0%, a rising net government debt of 52.3%, and a positive primary balance of 0.6% in a context of lower interest rates compared to the previous year. We think that despite some tailwinds for revenues, such as increased use of technology in customs and higher taxes on products from countries without a trade agreement with Mexico, more aggressive measures will be needed in 2026.

See more details below