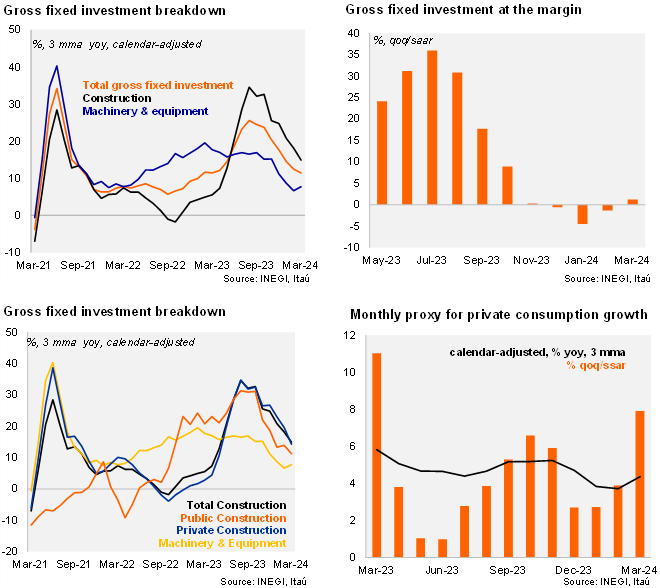

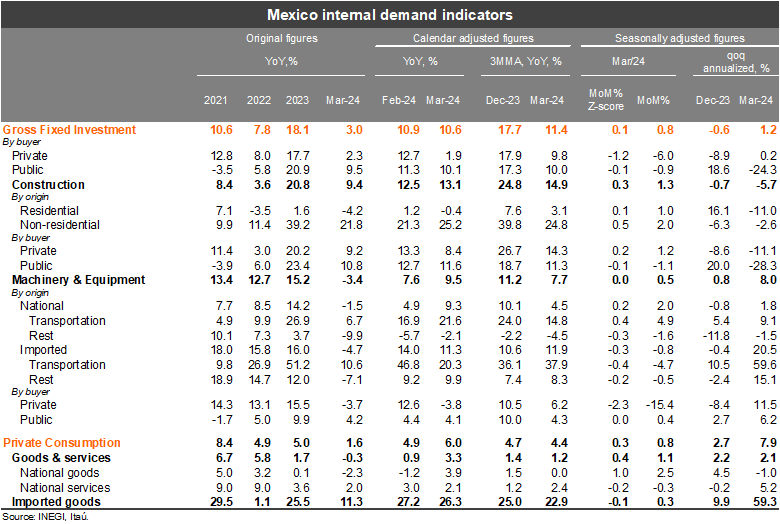

Gross Fixed Investment (GFI) expanded 3.0% yoy in March (vs. market consensus of 3.7%), while private consumption rose by 1.6% (vs. market consensus of 0.8%). The GFI figure was partly dragged by an unfavorable calendar base effect (Easter holidays). In fact, adjusting for working days, GFI grew 10.6% YoY in March, taking the 1Q24 annual rate to 11.4% (from 17.7% in 4Q23). According to the seasonally adjusted series, GFI expanded 0.8% MoM/SA in March, driven by construction investment, while machinery & equipment also expanded at a decent pace. GFI momentum improved, with the qoq/saar at 1.2% in 1Q24 (from -0.6% in 4Q23). Meanwhile, private consumption expanded 0.8% MoM/SA, driven by goods and services, likely associated to the expansionary fiscal stance concentrated in 1H24. The qoq/saar of private consumption stood at a resilient 7.9% in 1Q24.

Our take: Our GDP growth forecast for this year stands at 2.3%. After a soft 1Q24 GDP, we expect activity to recover in 2Q24, supported by an expansionary fiscal stance. However, activity is likely to be softer in 2H24, as fiscal expenditure drops after the elections and the government transitions from the current administration to the next. That said, resilient activity in the U.S. is supportive for Mexico’s growth outlook.

See detailed data below