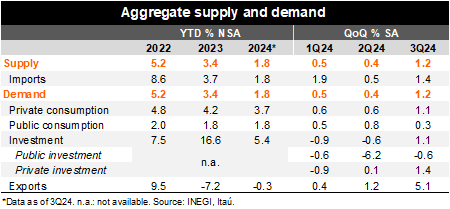

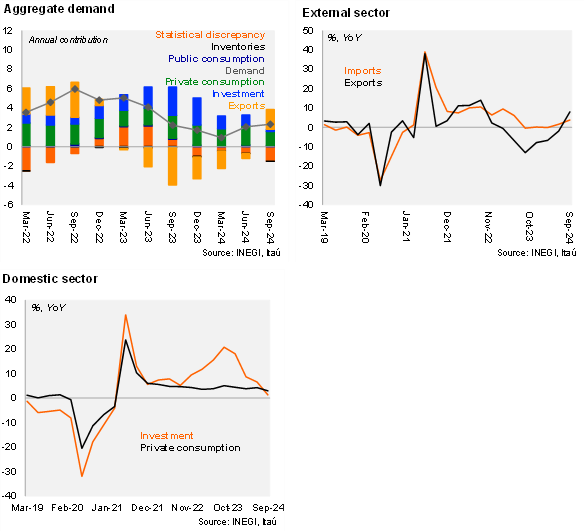

3Q24 aggregate supply and demand rose 2.3% YoY NSA (Bloomberg: 2.3%, prior: 2.1%). While the rise was broad-based, exports (8.0% YoY) were the highlight of the quarter, mainly due to the exchange rate depreciation and normalization of supply shocks. Private consumption remained strong at 3.0% YoY, while investment grew 1.3% YoY (from 6.6% 2Q24 and 8.7% 1Q24). In seasonally adjusted terms, aggregate demand accelerated 1.2% QoQ. Exports were the most dynamic component, up 5.1% against the previous quarter, while private investment rose 1.4% and private consumption 1.1%. On the other hand, imports increased 1.4%, despite the Peso behavior.

Our take: Today’s results are favorable and overall consistent with strength in activity during 2H24. This supports our view of a 1.7% expansion in GDP for 2024. For 2025, we expect domestic demand will continue losing steam, particularly investment, and consumption could moderate but still growing supported by fundamentals. Exports will increase due to a better outlook for the US manufacturing sector and a more depreciated USDMXN. Our 2025 GDP forecast is at 1.5%.

See detailed data below