2025/12/09 | Julia Passabom, Mariana Ramirez & Ignacio Martínez

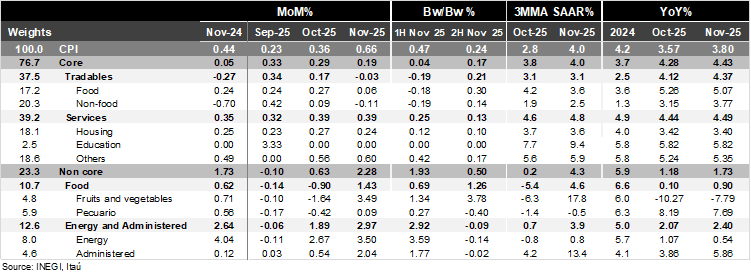

Bi-weekly headline CPI for the second half of November came at 0.24% 2w/2w, exceeding Bloomberg’s market consensus (0.07%) and our forecast (-0.04%). Core inflation came in at 0.17%, also above expectations (market flat; our forecast: -0.05%). Within the core component, tradables rose 0.21% 2w/2w, a sharp reversal from the first half of November (-0.19%). Importantly, non-food tradables increased 0.14%, defying expectations of price declines following the “Buen Fin” event, contributing to the upside surprise. Core services advanced 0.13% 2w/2w, with housing (0.10%) and other services (0.17%) leading the gains. The non-core component increased 0.50% 2w/2w, driven by significant rises in agricultural prices, particularly fruits and vegetables (3.8%).

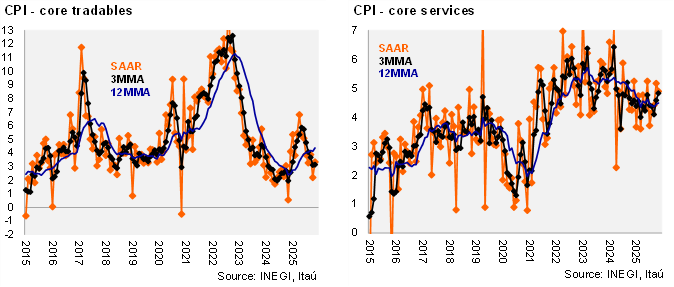

In annual terms headline inflation stood at 3.8% in November, up 0.23pp from October, but remaining below the 4% threshold since late April. Core CPI reached 4.43% YoY, 0.15pp higher than October, with tradables at 4.37% (up from 4.12%) and services at 4.50% (slightly up from 4.44%). Core measures accelerated at the margin, increasing inflation risks, especially on the services side. At the margin, core CPI rose to 4.0% 3MMA SAAR (from 3.8% in October), with tradables stable at 3.1% and services climbing from 4.6% to 4.8%.

Our take: Today’s report was an unwelcome surprise for inflation convergence. While we maintain our forecast for inflation to end 2025 at an above target 3.8% and only a modest decline to 3.7% in 2026, we remain cautious about next year’s inflation outlook, as non-core items could revert to historically higher averages. Regarding Banxico’s next meeting, we continue to expect a 25bps cut on Thursday, December 18, but anticipate a shift toward more date-dependent guidance, leaving the February 26 meeting wide open with a high bar for another cut.