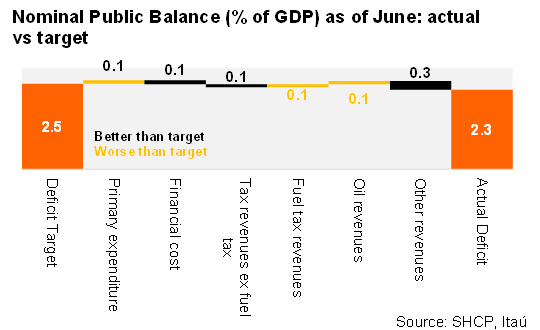

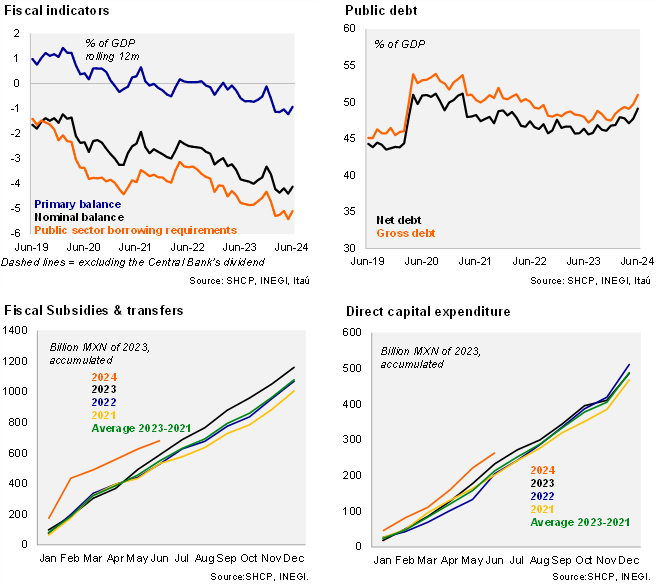

The nominal fiscal balance stood at a deficit of 2.3% of GDP as of 2Q24, compared to the MoF's 2.5% of GDP deficit target (also as of June) and the 2024 deficit target of 5.0%. On a 12-month rolling basis, the nominal fiscal deficit narrowed to 4.1% of GDP in June, down from a deficit of 4.4% of GDP in March, but above the deficit of 3.3% of GDP in 2023. The slightly lower-than-forecasted nominal fiscal deficit as of June, was driven mainly by lower financial costs and higher tax revenues (ex- fuel excise tax) and other revenues, which more than offset higher primary expenditure and lower than expected oil revenues and fuel excise tax (see chart below for further details).

Weaker oil revenues are explained by a decline in oil production, lower gas prices and a strong USDMXN despite higher oil prices as of June. However, we note that within oil revenues, PEMEX increased by 35.6% YoY as of June in real terms (vs. the Federal government which fell by 45.6%) as it reflects the capitalization from the federal government (around MXN 145 billion). The transfer is registered as financial expenditure also, having a neutral effect in the public sector balance. Tax revenues increased 6.2% as of June YoY, in real terms, driven mainly by the value added tax.

On the expenditure side, we note subsidies & transfers (+16.7% YoY as of June, in real terms), associated to social programs, seems to be normalizing after a strong start to the year, while direct capital expenditure, related to the culmination of large infrastructure projects expanded 13.2%. We estimate net public debt stood at 49.1% of GDP in June, compared to 46.8% end of 2023.

Finally, macroeconomic assumptions, which are used to estimate fiscal accounts, were left unchanged relative to the 1Q24 fiscal report, with an above consensus GDP growth forecast for 2024. The MoF’s 2024 GDP growth forecast of 2.6%, is significantly above our 1.6% call and consensus (1.9%), and that is likely to be revised down given soft 2Q24 activity data.

Our take: While the MoF’s above consensus call for 2024 GDP growth could place a downward bias to fiscal revenues, slower expenditure execution in 2H24 and the recent depreciation of the currency (supporting oil revenues) should keep the nominal fiscal deficit on target for this year. Our 2024 nominal fiscal deficit forecast stands at 5.0% of GDP, in line with the MoF’s target. However, reducing the nominal fiscal deficit to 2.5% of GDP next year will be challenging, amid a slowing economy, fiscal pressure from social programs, and apparent unwillingness to implement a revenue-enhancing tax reform (at least in the short term). We note that said 2.5% of GDP deficit target is preliminary, and was published by the MoF last March (2025 Preliminary economic policy guidelines), but recently President elect Sheinbaum has signaled a slightly less ambitious fiscal consolidation (a nominal fiscal deficit around 3.0% of GDP). The MoF has until November 15 to deliver the 2025 fiscal budget to Congress.

See detailed data below

Julio Ruiz