2025/08/27 | Julia Passabom & Mariana Ramirez

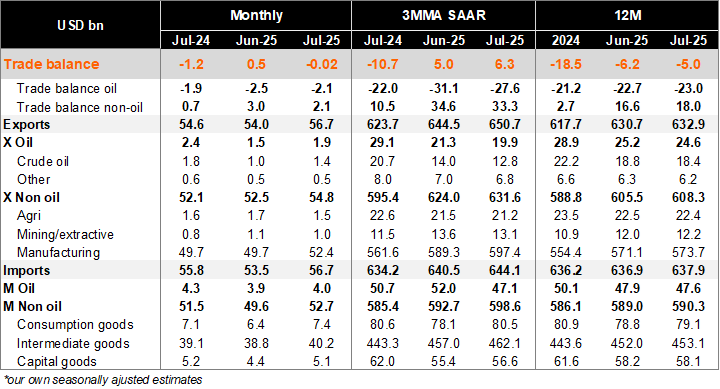

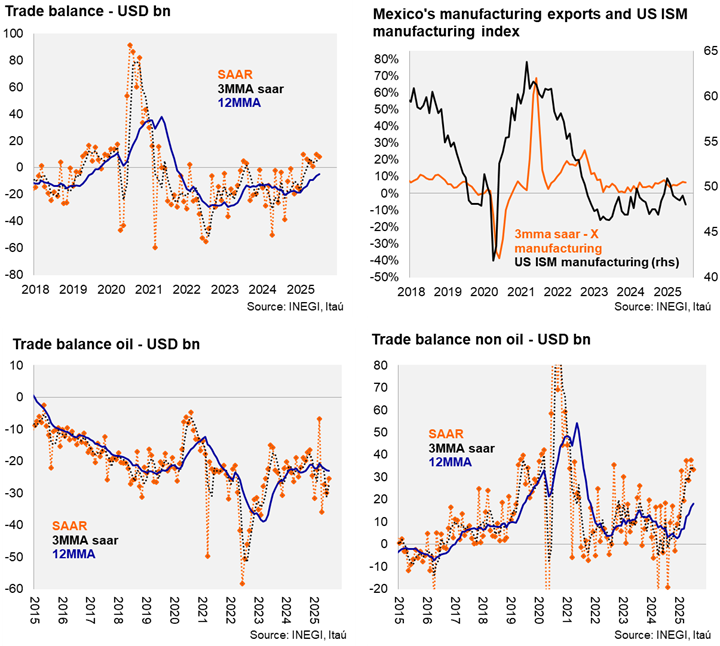

July’s trade balance revealed a goods deficit of USD 16.7 million, well below Bloomberg’s market consensus of a USD 750million surplus, but significantly above July 24’s deficit of USD 3.6 billion. On a 12-month rolling basis, the goods trade deficit reached USD 5.0 billion, narrowing from the USD 6.2 billion deficit in June. At the margin, using three-month annualized seasonally adjusted figures, the trade balance continued to improve, now showing a surplus of USD 6.3 billion (up from a USD 5.0 billion surplus in June). Examining the breakdown on a 12-month rolling basis, the oil trade balance continued to show a deficit (USD 23.0 billion deficit compared to a USD 18.0 billion surplus for non-oil), following the decline in domestic oil production and the government's strategy to prioritize domestic oil refineries.

Our view: The July trade balance highlights the strength of Mexico’s external accounts amid tariff-related uncertainty, with some signs of persistent front-loading in exports. Net exports remain the main driver of economic growth as we enter 3Q25. Capital goods imports showed some improvement at the margin, signaling some modest rebound in investments. Uncertainty surrounding Mexico’s trade relationship with the US will continue to challenge trade flows until a definitive USMCA renegotiation begins. Looking ahead, oil exports will be influenced by domestic policies related to national sovereignty and oil price dynamics. Weaker internal demand and a slowdown in construction are likely to limit non-energy consumption, particularly for non-residential projects.

See detailed data below