2025/08/21 | Julia Passabom & Mariana Ramirez

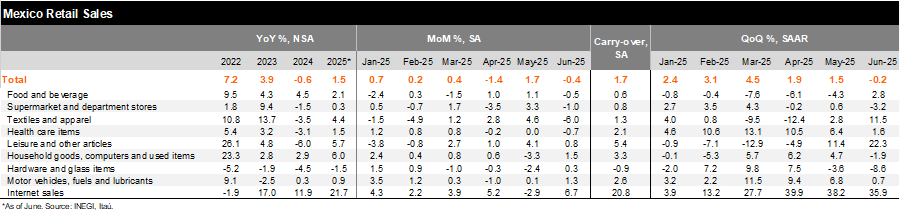

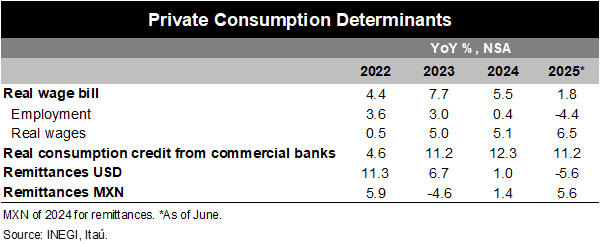

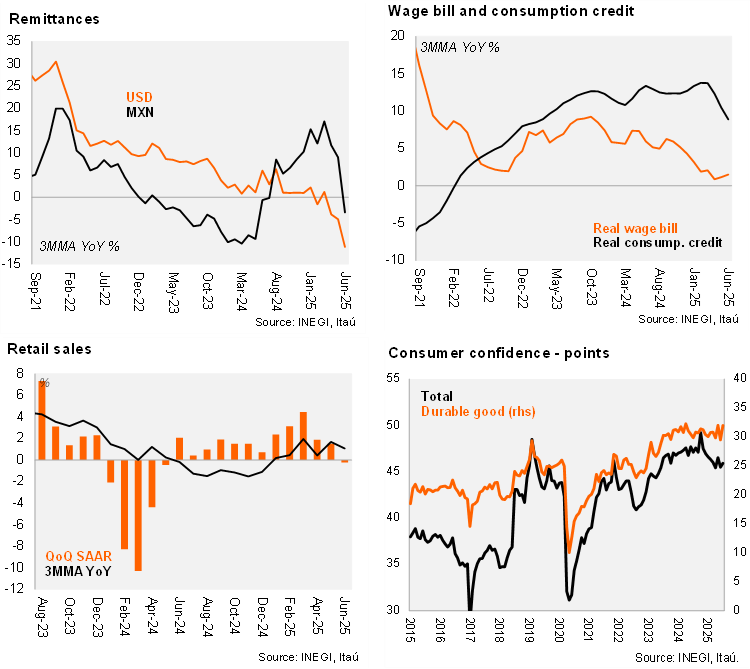

According to the survey of commercial companies, real retail sales grew by 2.5% YoY in June, in line with Bloomberg’s consensus. Adjusting for seasonality, real retail sales dropped sequentially by 0.4% MoM SA, a deeper fall compared to the consensus call of -0.2%. Four out of nine subsectors decreased in June, with textile and apparel articles down by 6.0%, supermarket by -1.0%, health and care items by -0.7%, and food and beverage by -0.5%. However, internet sales, household goods, motor vehicles, experienced expansions of 6.7%, 1.5% and 1.3% MoM, respectively. We still identify positive private consumption determinants, with the real wage bill rising by 1.8% YoY, and real consumption credit from commercial banks and remittances in MXN at 11.2% and 5.6%, respectively.

Our take: This data comes from a survey that identifies revenues from companies, which explains the difference from IGAE’s figures that consider value added. Today’s results have a negative bias, with the QoQ/SAAR at -0.2% (down from +1.5% in the previous quarter) and a statistical carry-over of +1.7% for the year. Due to resilient consumption determinants, such as the growing real wage bill and still historically high consumer confidence, we anticipate the sector will remain slightly positive in 2025. Additionally, we expect private consumption and net exports to be the main drivers of GDP growth this year.

See details below