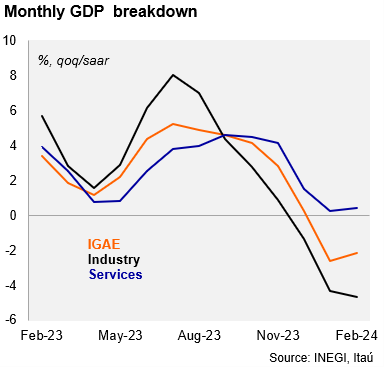

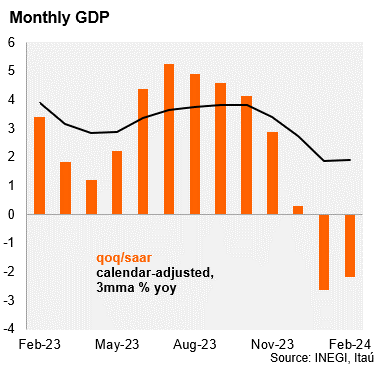

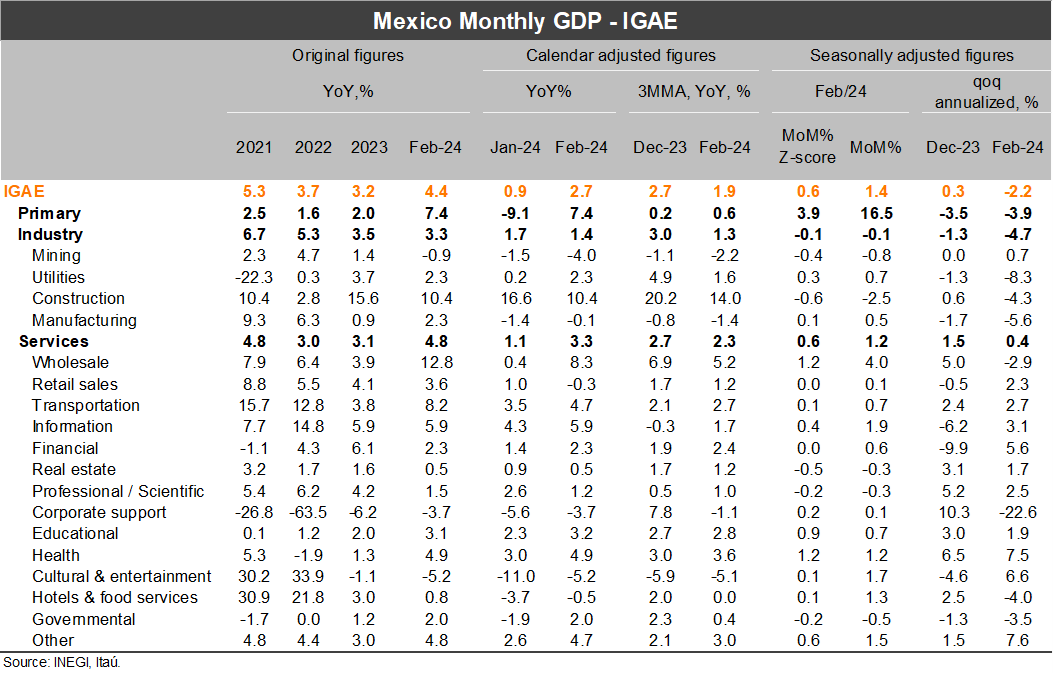

The monthly GDP (IGAE) increased 4.4% yoy in February, above market consensus of 2.7% (as per Bloomberg) and our forecast of 3.1%. The headline figure was supported, in part, by a favorable calendar base effect. In fact, using calendar adjusted figures, the monthly GDP stood at 2.7% in February, taking the quarterly annual rate to 1.9% (from 2.7% in 4Q23). At the margin, using seasonally adjusted figures, the monthly GDP still expanded at a strong pace of 1.4% MoM/SA, supported mainly by an improvement in the services sector (1.2%) and a strong primary output (16.5%) which was mitigated by a soft industrial production (-0.1%) dragged by construction. Activity momentum remained weak, with the qoq/saar of the monthly GDP falling by 2.2% in February (from -0.3% in 4Q23)

Our take: While February’s monthly GDP print was strong (after an upside surprise in retail sales last week), we still see a likely softer than expected activity sequential expansion in 1Q24 putting a downside bias to our GDP growth forecast of 2.8%. On the monetary policy front, the strong rebound in the services sector, consistent with the expansionary fiscal stance, is not constructive for a rate cut in the May’s 9 monetary policy meeting, where we expect Banxico to keep its policy rate unchanged at 11.00%.

See detailed data below

Julio Ruiz

|  |

| |