2026/02/05 | Julia Passabom, Mariana Ramirez & Ignacio Martínez

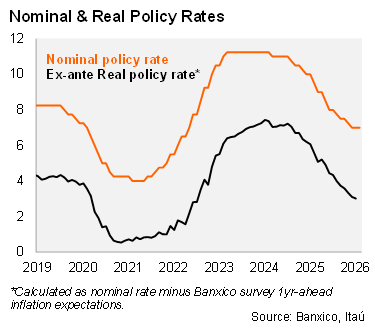

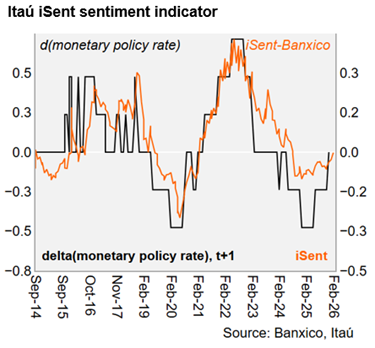

In its February meeting, Banxico’s Board kept the policy rate unchanged at 7.0%, in line with our call and the broad market consensus. The decision was unanimous, the first since May 2025, a first pause after twelve consecutive rate cuts. While the hold was anticipated, the forward guidance signaled that the pause applies “for this occasion,” while retaining the plural form of “adjustments” regarding future policy actions. This wording suggests that the Board continues to envision additional rate cuts ahead, once conditions allow.

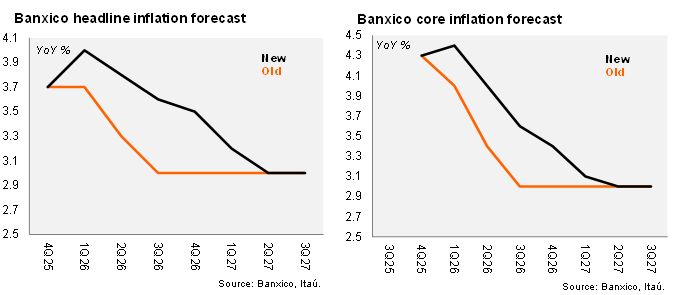

Banxico also introduced significant upward revisions to their inflation forecasts, again. The convergence of headline inflation to the 3% target is now projected for the second quarter of 2027, compared with the third quarter of 2026 indicated in December. The Board attributed the revision to the projected impact of recent increases in administered prices and excise taxes. Nonetheless, the new trajectory appears more consistent with a realistic and orderly disinflation path and is more aligned with prevailing market expectations. As such, the balance of risks to the inflation forecasts were now deemed as “more balanced, but still biased up”, from simply “biased up” in previous decisions.

Our take: Although the upward revision of inflation forecasts reflects heightened concern at Banxico regarding the disinflation process, the tone of the statement—highlighting that the pause is warranted “this time” and maintaining the plural “adjustments”—suggests that the Board still intends to resume easing once it assesses that price shocks stemming from higher tariffs and taxes has clearly dissipated. We continue to expect a terminal rate of 6.75% for this cycle, with a final cut in May, although risks have increased that the move could be brought forward to March, contingent on benign inflation data in upcoming releases. The meeting minutes will be published on February 19, and the quarterly inflation report on February 26.