Banco de Mexico (Banxico) unanimously maintained its policy rate unchanged at 11.00%, in line with our forecast and market expectations. The monetary forward guidance was changed slightly, adding the word “adjustments”, which in our view opens the possibility for a rate cut in the June meeting: “Looking ahead, it will assess the inflationary environment in order to discuss reference rate adjustments”. The real ex-ante rate currently stands at 7.19%, well above Banxico's 2.6% neutral real rate, and the highest among major economies in the region.

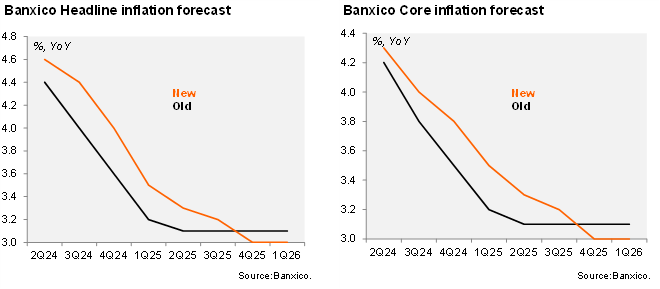

However, the tone was hawkish on the inflation environment. The statement noted that inflationary shocks will dissipate at a slower pace, leading to higher headline and core inflation forecasts for the next six quarters (see charts below). Also, the new projection implies a delay in the convergence of headline inflation to the 3% target to the 4Q25, instead of 2Q25. The communique emphasized that services inflation is expected to be more persistent, relative to previous forecasts.

The balance of risks for inflation remained tilted to the upside, with the list of upside and downside risks unchanged, relative to the previous statement. Upside risks to inflation include, persistence of core inflation, currency depreciation, greater cost related pressures, greater than expected resilience of the economy, climate related impacts and the intensification of geopolitical conflicts. On the other hand, downside risks for inflation include a faster than anticipated slowdown of the global economy, lower pass-through from cost related pressures and the appreciation of the currency.

Our take: While the tone of the statement was hawkish on the inflation environment, we think that the change in the monetary forward guidance opens the door for a rate cut in the next meeting (June 27). Three inflation prints are scheduled to be released before the next monetary policy meeting, and assuming no ugly inflation surprises, we think a rate cut in June is likely. However, we think that the odds of another pause afterwards are high given a still complicated inflation outlook, meaning our end of year policy rate forecast of 9.75% has an upward bias.