2025/11/06 | Julia Passabom & Mariana Ramirez

As expected, Banxico cut the policy rate by 25-bp to 7.25%. The decision was divided for the fourth consecutive time, with a 4-1 vote and a dissent from board member Jonathan Heath, who favored maintaining the rate, again. Contrary to our expectations, the forward guidance shifted to a meeting-by-meeting approach, now stating that “looking ahead, the Board will evaluate reducing the reference rate”. Following the decision, the one-year real ex-ante rate fell to 3.21%, crossing Banxico’s upper bound of the estimated neutral range for the first time since 2022 [interval: 1.8% - 3.6%, with a midpoint at 2.7%].

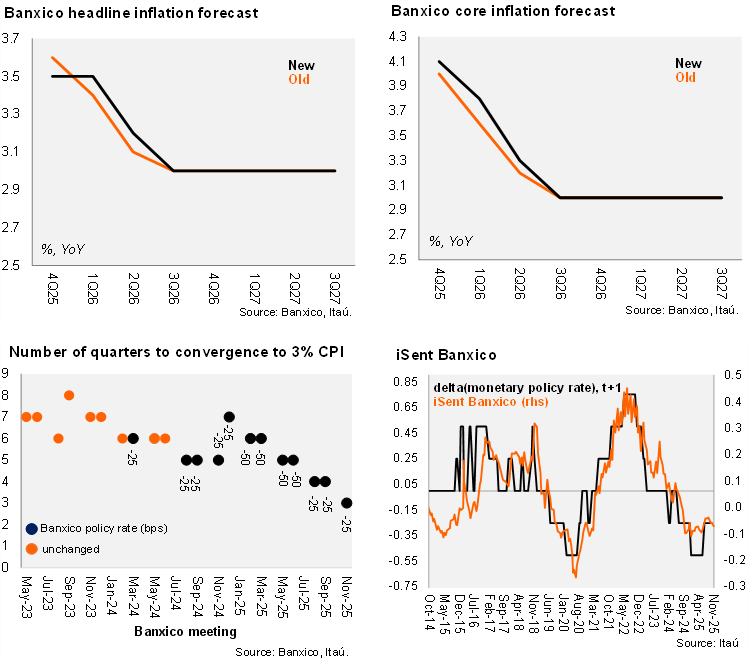

Banxico’s short-term headline and core inflation forecasts were slightly revised upward for 2026. Headline inflation is projected to be 3.5% in 2025 (down from 3.6%), while core CPI was updated to 4.1% (up from 4.0%). The expected convergence to the target remains unchanged for 3Q26. The statement noted again that the balance of risks for inflation continues to lean towards the upside, but there was a shift in the ranking of upside risks: the “persistence of core inflation” moved from risk number 3 to risk number 2 on the list.

Our proprietary Central Bank sentiment index for Mexico - iSent-Banxico – showed a modest decline, remaining in negative territory. iSent-Banxico does not suggest that the current easing cycle is nearing its end. Considering the Fed’s more cautious tone and the possibility of skipping rate cuts in December, due to scarce data and differing views on policy neutrality, we believe it is more likely that Banxico will deliver the 25-bp cut in December, while maintaining the flexibility of the singular forward guidance, which does not guarantee the next monetary policy move.

Our take: Today’s decision delivered the expected 25-bp cut, but the board shifted its communication to a meeting-by-meeting approach, now stating that “looking ahead, the Board will evaluate reducing the reference rate”. Consistent with today’s communication, we anticipate an additional 25-bp cut in December, leading to a year-end monetary policy rate of 7.0%. Our scenario also includes two more 25-bp cuts at the first two meetings next year, with the terminal rate reaching 6.5%. We expect Banxico to be more dependent on CPI and FOMC dynamics next year. Banxico is scheduled to publish the monetary policy meeting minutes on November 20, which should provide insight into the decision and board dynamics, particularly regarding the discussion on the singular forward guidance in this meeting. We will also be attentive to diverging views on the estimation of the neutral rate, as its upper bound was crossed. The quarterly inflation report will be released on November 26, and the next monetary policy meeting will take place on December 18.