2025/08/07 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

As expected, Banxico cut the policy rate by 25-bp to 7.75%, changing the previous pace of 50-bp over the last four meetings. The decision was divided once again, with a 4-1 vote and a dissenting vote by board member Jonathan Heath, who favored holding the rate. Additionally, the forward guidance remained unchanged, stating that "the board will assess further adjustments to the reference rate". Following the decision, the one-year real ex-ante rate fell to 3.95%, still well above Banxico's real neutral estimate of 2.7%.

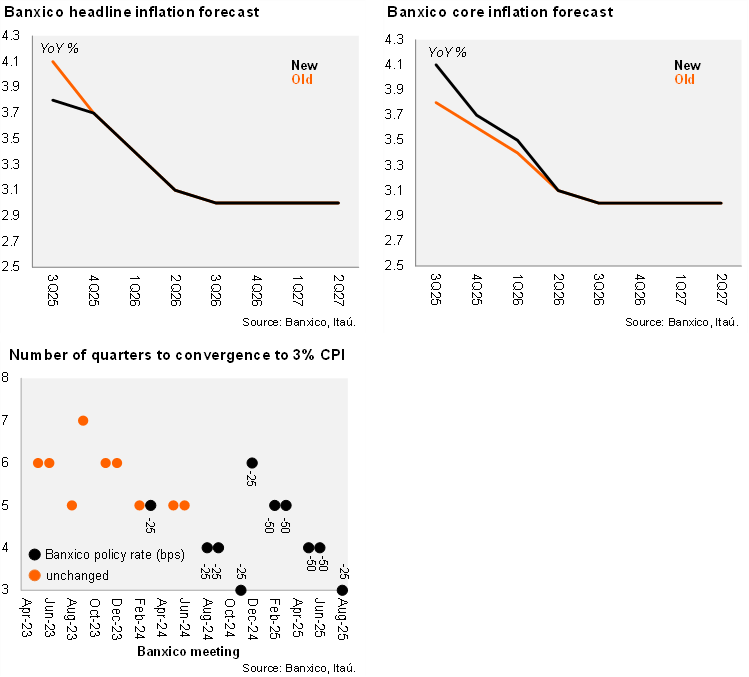

Banxico's short-term inflation forecast remained practically unchanged for the headline, while core inflation forecasts were revised slightly upwards for the short-term. Headline inflation remains at 3.7% by the end of 2025 and core CPI was revised from 3.6% to 3.7% in the same horizon. Expected convergence to the target was left unchanged by 3Q26. The statement noted that the balance of risks for inflation continues to lean towards the upside, repeating the text from the previous statement. Regarding the terminal rate, Banxico stated that the decision relied on the well-behaved peso, the deceleration in economic activity, and the potential consequences of changes in trade policies.

Our take: Today’s decision delivered a 25-bp cut and maintained the same forward guidance, indicating future adjustments (plural) ahead. Given recent inflation dynamics and lower interest rate differentials with the US, we believe Banxico will adopt a meeting-by-meeting approach going forward. We expect one last 25-bp cut to occur at the next meeting, leading to a terminal rate of 7.5% in 2025. Banxico may cut further, depending on inflation dynamics, the currency's performance, and the Fed's actions. We anticipate only one 25-bp cut by the Fed this year, in December. Banxico is scheduled to publish the monetary policy meeting minutes on August 21, which should provide insight into the decision and board dynamics. The quarterly inflation report will be released on August 27 and the next monetary policy meeting will take place on September 25.