As expected, Banxico cut the policy rate by 50 bps for the fourth consecutive meeting to 8.0%, this time in a split decision (4-1, with a dissent vote by board member Jonathan Heath for a hold). Additionally, the forward guidance stated that "the board will assess further adjustments to the reference rate", removing the previous indication of another adjustment of the same magnitude but using the plural this time to signal beyond the next meeting. Following the decision, the one-year real ex-ante rate fell to 4.26%, still well above Banxico's real neutral estimate of 2.7%.

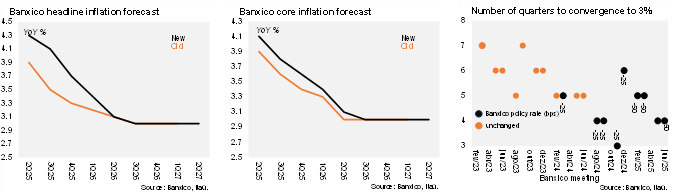

Banxico's short-term inflation forecast was revised up for the second consecutive decision, likely reflecting greater-than-expected actual inflation: headline inflation was adjusted from 3.9% to 4.3% for 2Q25, with year-end forecasts revised to 3.7% from 3.3% in 2025, and remaining unchanged at 3.0% for 2026, with convergence to the target expected unchanged by 3Q26. The statement noted that the balance of risks for inflation still leans towards the upside, with goods inflation increasing more than expected. Regarding the terminal rate, Banxico stated that the decision relied on the well-behaved peso and the deceleration in economic activity, along with the potential consequences of changes in trade policies ahead. The statement also dropped the explicit reference to the restrictive stance on monetary policy, which was also expected in our view, given the current state of the easing cycle.

Our take: Today’s decision delivered a 50-bp cut, followed by forward guidance indicating future adjustments (plural) ahead. The inflation forecast was adjusted to the upside compared to the previous meeting (+40-bp at the end of this year). Given recent inflation dynamics and lower interest rate differentials with the US, we believe Banxico will opt for more cautious pace going forward, with two 25-bp cuts in August and September, leading to a terminal rate of 7.5% in 2025. Banxico may cut further, although this should consider inflation dynamics and the Fed. Our international scenario considers only one 25-bp cut by the Fed this year, in December. Banxico is scheduled to publish the monetary policy meeting minutes on July 10, which should shed light on the decision and board dynamics. The next monetary policy meeting is scheduled for August 7, with the quarterly inflation report to be released on August 27.