As expected, Banxico cut the interest rate by 50-bps to 8.5% in a unanimous decision. Additionally, the forward guidance signaled another 50-bps cut in the following meeting, stating that “looking ahead it could continue calibrating the monetary policy stance and consider adjusting it in a similar magnitude.” The one-year real ex-ante rate of 4.54% remains above Banxico’s real neutral estimate of 2.7%.

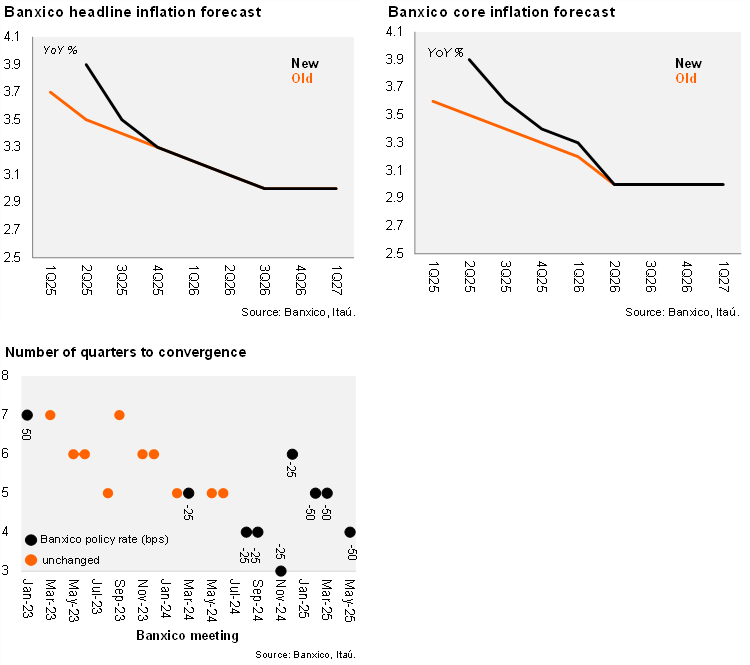

Banxico’s inflation forecast path saw only a modest short-term revision: headline inflation was adjusted from 3.5% to 3.9% for 2Q25, but year-end forecasts remained at 3.3% for 2025 and 3.0% for 2026, with convergence to the target expected by 3Q26. The statement noted that the balance of risks for inflation still leans towards the upside, but “it has improved as the global shocks have been fading.” Regarding the terminal rate, Banxico kept the reference to “continue the rate cutting cycle, albeit maintaining a restrictive stance” and the board “considered that reference rate levels … are consistent with the challenges posed by the present stage”.

Our take: Today’s decision delivered a 50-bp cut, followed by forward guidance indicating a similar adjustment at the next meeting (June 26). The statement and inflation forecast were broadly the same as those from the previous meeting. The continuation of the current dovish tone, although in line with our expectations, was not a consensus, given the somewhat better-than-expected activity data for 1Q25 and the recent inflation prints with core inflation close to 5%, at the margin. We continue to expect another 50-bp cut in June. Beyond that, we anticipate a more cautious approach, with two 25-bp cuts in August and September, leading to a terminal rate of 7.5% in 2025. Banxico is scheduled to publish the quarterly inflation report on May 28. The following day (May 29), Banxico will release the monetary policy meeting minutes, which should shed light on the decision and board dynamics.

Our take: Today’s decision delivered a 50-bp cut, followed by forward guidance indicating a similar adjustment at the next meeting (June 26). The statement and inflation forecast were broadly the same as those from the previous meeting. The continuation of the current dovish tone, although in line with our expectations, was not a consensus, given the somewhat better-than-expected activity data for 1Q25 and the recent inflation prints with core inflation close to 5%, at the margin. We continue to expect another 50-bp cut in June. Beyond that, we anticipate a more cautious approach, with two 25-bp cuts in August and September, leading to a terminal rate of 7.5% in 2025. Banxico is scheduled to publish the quarterly inflation report on May 28. The following day (May 29), Banxico will release the monetary policy meeting minutes, which should shed light on the decision and board dynamics.