2025/09/25 | Julia Passabom & Mariana Ramirez

As expected, Banxico cut the policy rate by 25-bp to 7.50%. The decision was divided once again, with a 4-1 vote and a dissenting vote by board member Jonathan Heath, who favored maintaining the rate. Additionally, the forward guidance remained unchanged, stating that "the board will assess further adjustments to the reference rate". Following the decision, the one-year real ex-ante rate fell to 3.60%, which is still well above Banxico's real neutral estimate of 2.7%.

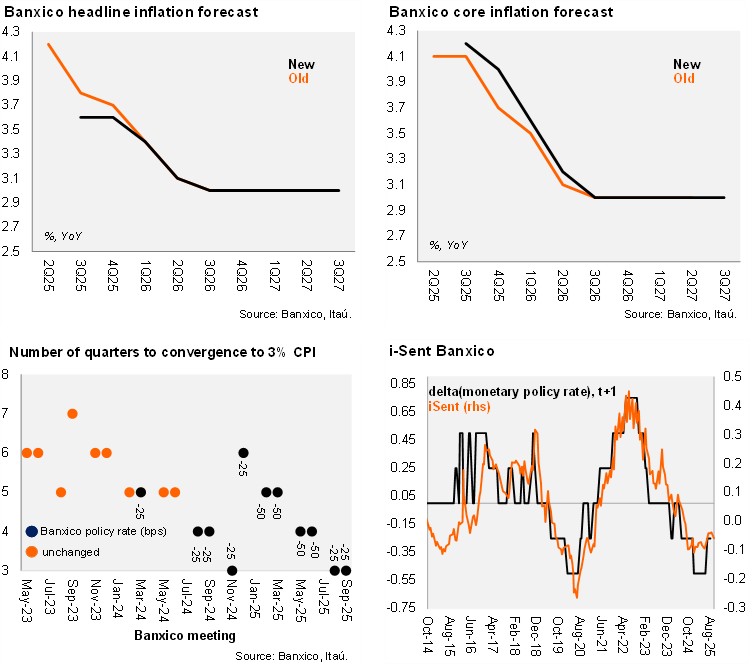

Banxico’s short-term headline inflation forecasts were slightly revised downward for the near term, while core inflation forecasts were revised slightly up for the short term. Headline inflation is projected to stand at 3.6% in 2025 (down from 3.7%), and core CPI was updated to 4.0% (up from 3.7%). The expected convergence to the target remains unchanged by 3Q26. Barring any shocks, if current dynamics (USDMXN and overall CPI trajectory) remain stable, Banxico is likely to maintain its forward guidance (plural) in November as well.

The statement noted that the balance of risks for inflation continues to lean towards the upside. Our proprietary Central Bank sentiment index for Mexico - iSent-Banxico – showed a slight decline at the margin, indicating a more dovish stance than the previous statement. iSent-Banxico does not suggest that the current easing cycle is nearing its end, which aligns with the board’s official dovish communication. Given the current expectations for the easing cycle by the FOMC, Banxico seems inclined to continue cutting rates as long as the data, particularly inflation and the USDMXN, allow them to do so.

Our take: Today’s decision delivered a 25-bp cut and maintained the forward guidance, indicating future adjustments (plural) ahead. Consistent with today’s communication, we expect two additional 25-bp cuts to take place at the November and December meetings this year, leading to a year-end monetary policy rate of 7.0%. Additionally, our scenario incorporates another two 25-bp cuts at the first two meetings next year, with the terminal rate reaching 6.5%. Banxico is scheduled to publish the monetary policy meeting minutes on October 9, which should provide insight into the decision and board dynamics.