Banco de Mexico (Banxico) kept its policy rate unchanged at 11.00%, in line with our forecast and market expectations (as per Bloomberg). It was a split decision, with deputy governor Omar Mejía voting for a 25-bp rate cut. According to our estimates, the one-year real ex-ante rate stands at 7.20%, well above Banxico’s real neutral estimate of 2.6%.

The forward guidance was similar to the previous statement but, in our view, increased the board’s willingness to consider a rate cut in the next meeting. The new forward guidance states: “Looking ahead, the Board foresees that the inflationary environment may allow for discussing reference rate adjustments”. The previous forward guidance mentioned: “Looking ahead, it will assess the inflationary environment in order to discuss reference rate adjustments”. We also note that in the same paragraph, the new statement now emphasizes that they will consider the effects on inflation from weaker than expected activity.

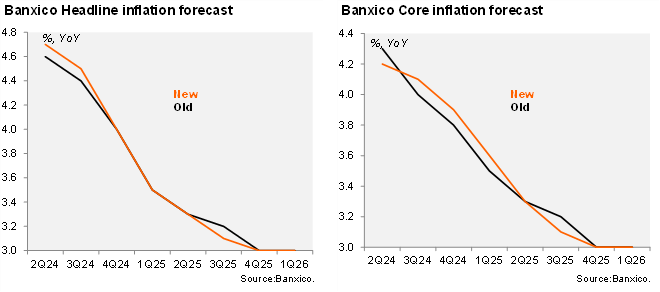

Banxico’s inflation forecast path was revised slightly to the upside in the short term, still converging to the target in 4Q25. According to the statement, the revision considers the impact from the currency depreciation on inflation which are partly offset by weaker than anticipated economic activity.

The balance of risks for inflation remained tilted to the upside, eliminating greater than expected resilience of the economy as an upside risk (relative to the previous statement). The statement also includes other upside risks to inflation including the persistence of core inflation, currency depreciation, greater cost related pressures, climate related impacts and the intensification of geopolitical conflicts. On the other hand, downside risks for inflation include a faster than anticipated slowdown of activity, lower pass-through from cost related pressures and a lower-than-anticipated effect of the peso’s depreciation on inflation.

Our take: All in all, the tone of the statement (new forward guidance, emphasis on weaker than anticipated activity and slight changes to the inflation forecast path) and the fact that one of the board members already voted for a rate cut, suggest Banxico could resume its easing cycle in the next monetary policy meeting (August 8). Our base case remains for the central bank to cut its policy rate by 25-bp in each of the remaining meetings of the year, reaching an end of year level of 10.00%. We think the highly restrictive monetary policy stance relative to the smaller inflationary gap allows for rate cuts this year. Our call has the risk of another pause depending on further market volatility stemming from the new political landscape. The monetary policy minutes to be published two weeks from now will shed more light on the willingness of the rest board members to vote for a rate cut.