In a unanimous decision, Banco de Mexico (Banxico) cut its policy rate by 25-bp, to 10.0%, in line with the Bloomberg’s consensus, but lower than our 50-bp call. The one-year real ex-ante rate of 6.0% continues above Banxico’s real neutral estimate of 2.7%.

The new forward guidance was more dovish, adding that "in view of the progress on "disinflation, larger downward adjustments could be considered in some meetings, albeit maintaining a restrictive stance.”. We noted that the previous forward guidance mentioned only additional rate cuts, but nothing on the magnitude.

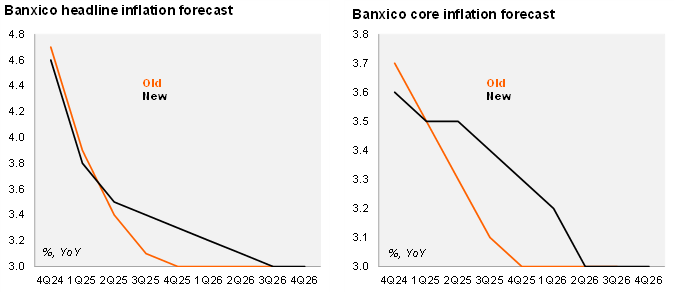

As expected, Banxico’s inflation forecast path was revised slightly to the downside in the short term. However, due to the uncertainty about the trade policy in the US, their forecast increased after 2Q25 such that the convergence to the target will come only at 3Q26. According to the statement, the balance of risks for inflation remained tilted to the upside and the main difference between the last statement was the upside risk coming from trade policies/tariffs. However, they recognized that core inflation has continue in a downward trend, which might continue in the future.

Our take: The unanimous decision towards the 25-bp cut was a surprise, in our view, given the recent communication of the board as well as the discussion presented in the minutes of the November meeting. The statement also kept the balance of risks for inflation as tilted to the upside, besides revising up the previous inflation forecast. Our base case remains for the central bank to accelerate its pace in the first meeting of 2025, cutting the monetary policy rate by 50-bp on February 6th. Although the statement communication points in this direction, our current FOMC scenario indicates caution, and a worsening of global financial conditions could prevent a larger cut next year. We also interpret updated guidance as allowing for larger cuts to take in certain meetings, not necessarily implying a string of constant larger cuts. The monetary policy minutes to be published three weeks from now (January 9th) will shed more light on the willingness of the board to change the current pace.