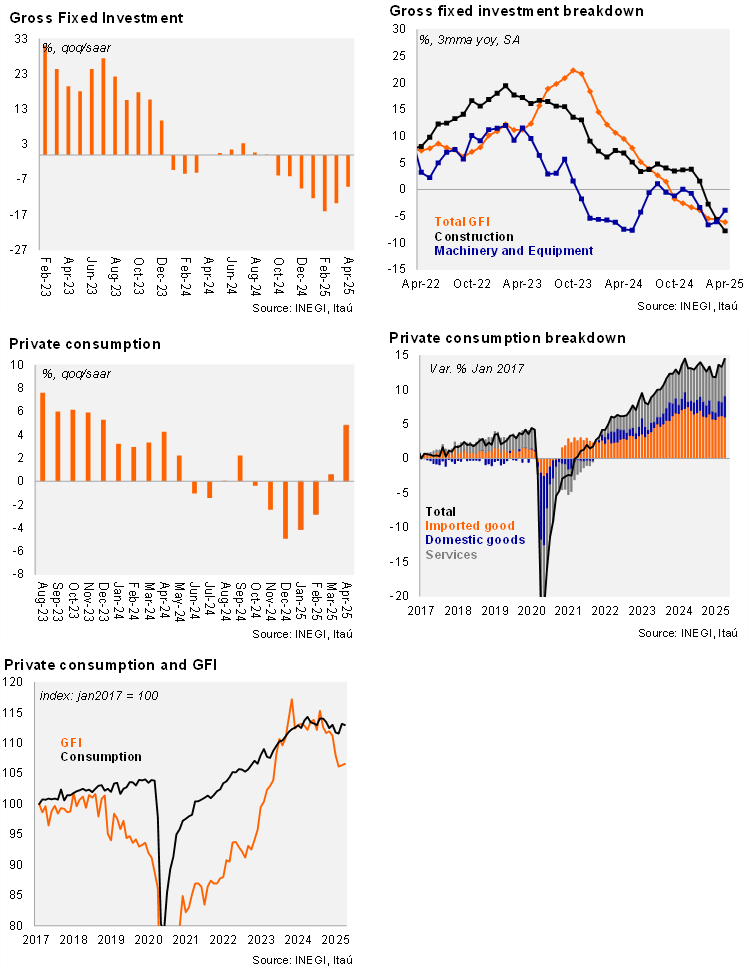

Gross Fixed Investment (GFI) fell by 12.5% YoY in April, a deeper contraction than Bloomberg’s consensus of -9.1%. By sector, machinery and equipment decreased by 16.0%, with both imported and domestic components declining. Construction fell by 9.2% YoY, with public and non-residential components also declining. Using seasonally adjusted data, investment decreased by 1.7% MoM, lower than market expectations of -0.7%. Machinery and equipment fell by 2.2% MoM, while construction contracted by 1.1% due to a reduction in residential construction, with non-residential construction acting as a counterweight (+3.0%) following three consecutive months of contractions.

On the other hand, private consumption stood at -1.7% YoY, better than the consensus of -3.6%. On a monthly basis, using seasonally adjusted data, private consumption rose by 1.1%, with domestic goods and services showing positive performance of 2.0% and 0.7%, respectively. However, imported goods fell by 1.0% after two consecutive months of growth.

Our view: April's domestic demand figures showed slightly better results at the margin, with investment being less negative at 9.1% QoQ/SAAR and consumption up by 4.8%. Looking ahead, economic activity could improve if uncertainties regarding trade policy moderate significantly, which might support private investment and sectors sensitive to external demand. For 2025, we forecast GDP growth at 0.2%. Regarding the policy rate, weak activity, combined with Fed’s actions, favor a 25-bp cut at Banxico’s next meeting (August 7) to 7.75%.

See details below