2026/01/15 | Julia Passabom, Mariana Ramirez & Ignacio Martínez

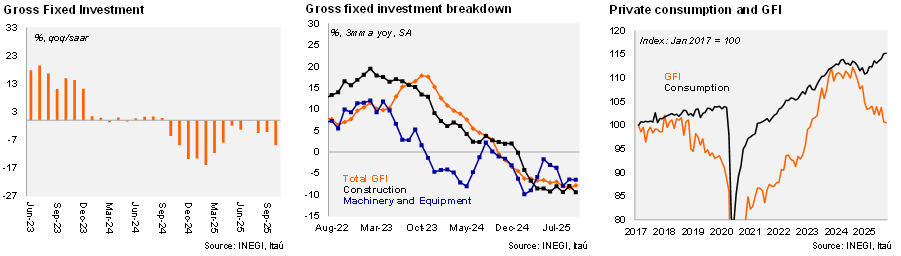

Gross Fixed Investment (GFI) fell by 5.5% YoY in October, a greater contraction than Bloomberg’s consensus of -3.9%. September data was revised slightly down to 6.8% from 6.7%. By sector, machinery and equipment posted a significant decline of 10.5%, with all sub‑components decreasing: domestic equipment fell by 12%, while imported equipment contracted by 9.5%. The construction sector recorded a smaller drop of 0.7%, with mixed performance across its categories. On one hand, residential construction and the private sector rose by 13.5% and 7.9%, respectively; on the other hand, non‑residential construction and public investment decreased by 12.2% and 32.3%. Based on seasonally adjusted data, total investment increased by 0.9% MoM, below market expectations of a 1.7% rise. Machinery and equipment fell by 2.2%, while construction grew by 3.9%, driven by increases in both residential and non‑residential segments.

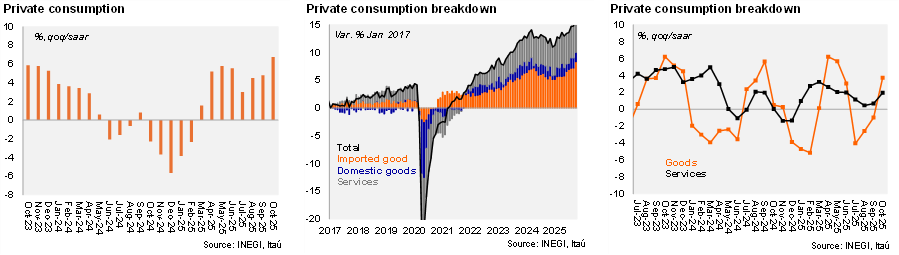

Private consumption increased by 4.2% YoY, slightly higher than market consensus of 4.0%. September data was also revised upward to 3.8% from 3.6%. By sector, the main driver was imported goods, which rose 20% YoY, while domestic goods consumption increased more modestly (+1.3%). On a monthly basis, using seasonally adjusted figures, private consumption rose 0.8%—the fifth consecutive increase. This month’s gain was supported by a 6.6% rise in imported goods, whereas domestic consumption remained flat.

Our take: October data continues to show that the positive performance of private consumption stands in sharp contrast to the weak results on the investment side. Although there is some mixed behavior across specific investment categories, overall the sector remains significantly depressed. As such, growth in the final part of last year was likely driven primarily by private consumption. We estimate GDP growth for last year at 0.3%, and for this year we expect a recovery toward a 1.5% expansion.