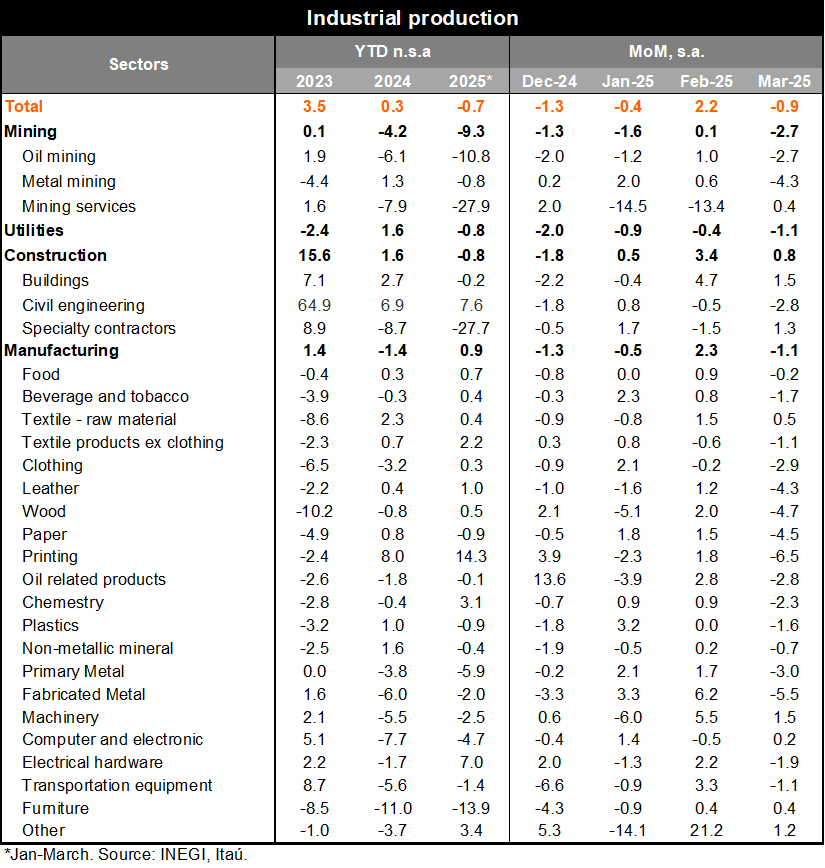

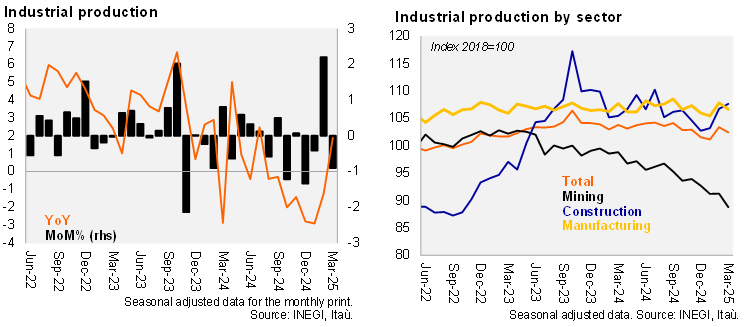

Industrial production (IP) rose by 1.9% YoY in March, between Bloomberg’s market consensus of 1.5% and our forecast of 2.6%. The annual figures showed mixed results, with construction and manufacturing growing by 5.4% and 3.1%, respectively, while mining and utilities decreased by 9.5% and 1.9%, respectively.

Using seasonally adjusted figures, IP decreased by 0.9% MoM, following strong growth last month and worse than INEGI’s nowcast of zero growth. This performance was driven by declines in mining (-2.7%, with contractions in metals and oil), manufacturing (-1.1% MoM, with 16 out of 21 subsectors decreasing), and utilities (-1.1%). Construction partially offset the contraction, growing by 0.8% due to building edification and specialty trade contractor services. Momentum in the industrial sector remained weak in March, with the QoQ/SAAR at -0.5%, although this was an improvement from -5.0% in February.

Our take: Today’s released showed a slightly positive historical data revision, which resulted in a less negative performance during the beginning of this year. Overall, results continued to have a negative bias for the first quarter, with the QoQ/SAAR at -0.5%. Looking ahead, we continue to expect that shifts in US trade policy will generate distortions in manufacturing exports, such as temporary inventory accumulation and a reorganization of supply chains. Additionally, high uncertainty is likely to be reflected in low levels of private investment in Mexico, which should imply weak private construction and manufacturing ahead. The government is focused on strengthening domestic activity amid changes in the global outlook, which might modestly drive public construction in the second half of 2025.

See more details below