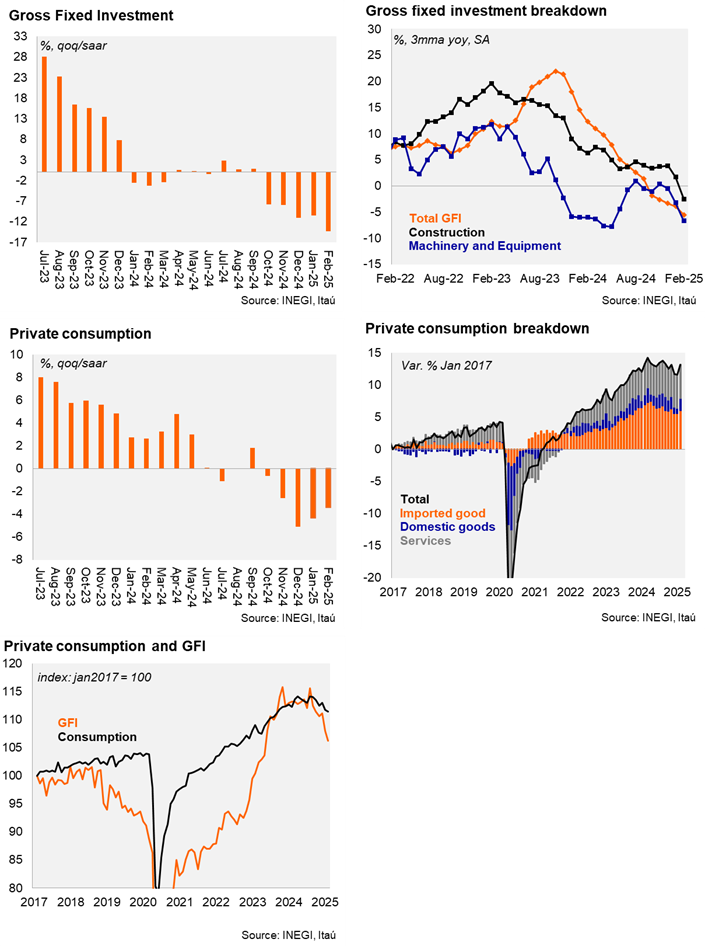

Gross Fixed Investment (GFI) fell by 7.8% YoY in February, a deeper contraction than Bloomberg’s consensus of -5.0%. By sector, machinery and equipment decreased by 10.4%, with both imported and domestic components declining. Construction fell by 5.2% YoY, with public and non-residential components also declining. Using seasonally adjusted data, investment increased by 0.1% MoM, which was lower than market expectations of +0.9%. Machinery and equipment fell by 1.1% MoM, while construction rose by 1.7% due to residential growth, with non-residential construction acting as a drag (-1.7%) due to the completion of public infrastructure projects from AMLO’s administration last year.

Private consumption stood at -1.9% YoY, slightly better than the consensus of -2.1%. On a monthly basis, using seasonally adjusted data, private consumption rose by 1.2%, with positive performance across all components: domestic goods increased by 2.1%, imported goods by 2.7%, and services by 0.3%. Results were better than INEGI’s private consumption nowcast, which projected a contraction of 0.1% MoM in February.

Our view: February's domestic demand figures were affected by the leap year, mainly in private consumption, and they continued to show weak results at the start of 1Q25, with investment down 14.2% QoQ/SAAR and consumption down 3.4%. Looking ahead, economic activity could improve if uncertainties regarding trade policy moderate materially, which might support private investment and sectors that are sensitive to external demand. For 2025, we forecast a 0.5% GDP contraction. Regarding interest rates, weak activity adds to the recent Board communication favoring a 50-bps cut at Banxico’s next meeting (May 15) to 8.5%

See details below